The Czech National Bank (CNB) has made a bold move into the cryptocurrency and tech sectors, revealing in its latest regulatory filing that it has added Coinbase Global shares to its U.S. investment portfolio and increased its holdings in Palantir Technologies.

Czech National Bank Enters Crypto with Coinbase

According to a recently filed Form 13F with the U.S. Securities and Exchange Commission, the CNB acquired 51,732 shares of Coinbase, valued at over $18 million by the end of Q2 2025. This marks the first official entry by the Czech central bank into the crypto ecosystem via equity investments.

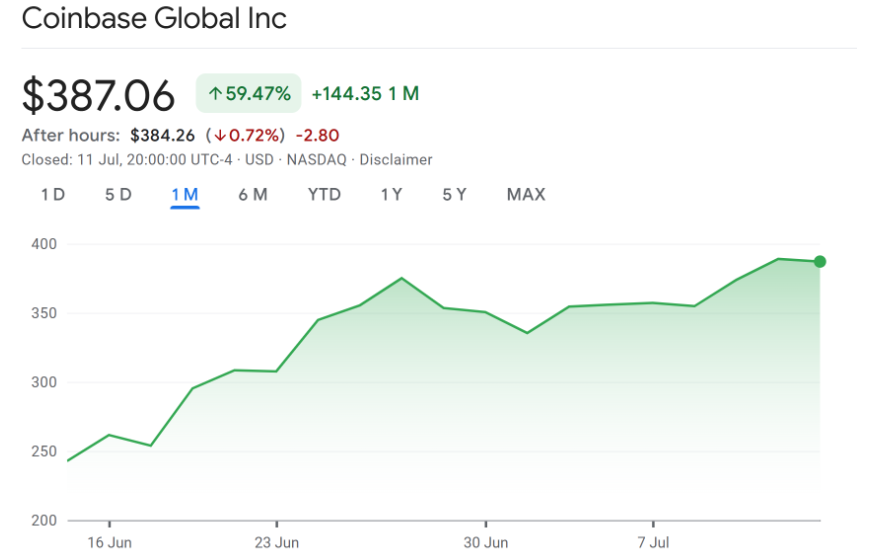

Coinbase, a leading cryptocurrency exchange, recently became the first crypto firm to join the S&P 500, highlighting growing institutional recognition. The company’s stock price has soared—up 60% over the past month—driven by strong market momentum and strategic acquisitions.

Palantir Investment Grows with Market Surge

The central bank also increased its position in Palantir Technologies, adding 49,135 shares in the second quarter. The CNB now holds a total of 519,950 Palantir shares.

Palantir’s stock has surged by 80% in the first half of 2025, outpacing the broader S&P 500’s 5.5% gain. The data analytics company has benefited from the booming interest in artificial intelligence (AI) and impressive earnings performance.

Coinbase Expands Despite Revenue Challenges

Despite Coinbase’s Q1 2025 revenue dropping by 10% to $2 billion, and net income falling 95% to $66 million due to a $596 million unrealized crypto loss, investor sentiment remains positive. Earnings per share came in at $1.94, beating analyst expectations.

Transaction volume fell 10.5% to $393 billion, partly impacted by global market conditions and tariff pressures from the Trump administration. Yet, the exchange is rapidly expanding, most notably with its $2.9 billion acquisition of Deribit, a top crypto options platform.

Additionally, Coinbase recently acquired Liquifi, a token management and compliance platform. This move strengthens its support for early-stage tokenization and smart contract projects, cementing its role in the evolving DeFi landscape.

Central Bank Bets on Tech and Crypto

The Czech National Bank’s strategic shift reflects a growing trend of central banks and institutions diversifying into tech and digital asset sectors. As Coinbase and Palantir continue to grow, the CNB’s portfolio adjustments may prove to be timely and forward-looking.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.