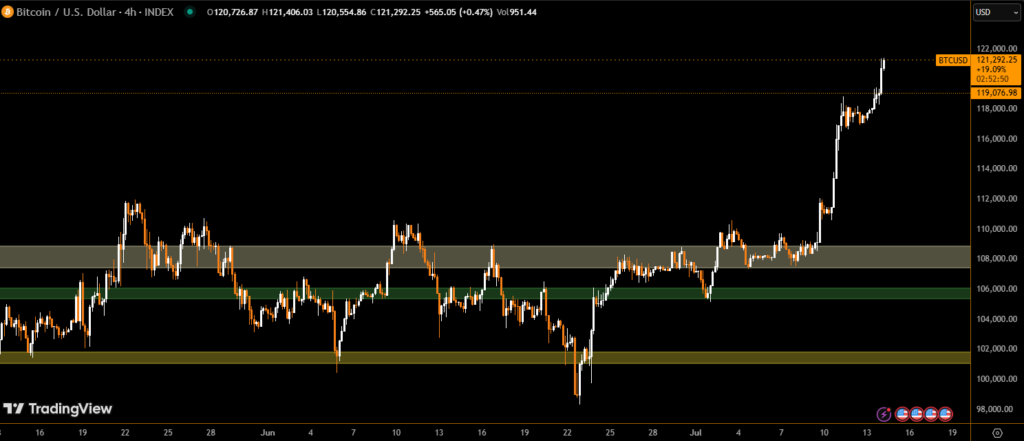

Bitcoin (BTC) has officially reached a new all-time high, crossing $121,000 for the first time in history. This marks a 28% year-to-date gain and signals renewed bullish momentum as investors brace for key U.S. inflation data expected later this week.

Bitcoin Breaks Out After Trade Tariff Shock

The move comes in the wake of President Donald Trump’s announcement of a 30% tariff on goods from the EU and Mexico, starting August 1. This policy decision added fresh volatility to traditional markets while strengthening Bitcoin’s safe-haven appeal.

BTC is currently trading at around $120,915, up sharply from a recent low near $96,000 in late June.

According to technical analysts, this breakout concludes a wave (ii) correction phase and kicks off a strong continuation pattern toward higher targets.

U.S. Inflation Data to Guide Short-Term Momentum

Market focus now shifts to the June Consumer Price Index (CPI) release, scheduled this week. Economists polled by FactSet expect:

- Headline CPI: +0.25% month-over-month, 2.6% annualized

- Core CPI (ex-food and energy): +0.3% month-over-month, 3.0% annualized

Rising inflation could delay the Federal Reserve’s expected interest rate cuts, potentially slowing BTC’s near-term advance. However, analysts believe the downside is limited given strong market structure and demand trends.

John Glover Predicts $136K BTC by Year-End

Ledn CEO John Glover believes the current breakout confirms long-term bullish projections. In a statement, he said:

“We have finally broken to new highs, confirming the end of the wave (ii) pullback. While the ultimate target of $136,000 remains unchanged, it now appears likely to arrive by year-end 2025, not Q1 2026 as previously expected.”

The market is supported by:

- Strong ETF inflows

- Growing corporate BTC adoption

- A favorable U.S. regulatory environment

- https://www.coindesk.com/markets/2025/07/14/bitcoin-hits-new-all-time-high-above-120k-as-us-inflation-data-looms

Bull Market Accelerates With Fresh Highs

Bitcoin’s breakout above $121,000 signals more than just a psychological victory — it reflects mounting institutional demand and macroeconomic shifts that favor decentralized assets. If the CPI data stays within expectations and regulatory momentum continues, the path to $136K may unfold faster than originally projected.

As inflation, trade tensions, and fiscal uncertainty grip global markets, Bitcoin continues to assert itself as a strategic digital asset with room for further upside.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.