Druk Holding Transfers 650 BTC Over Two Weeks Amid Bullish Momentum

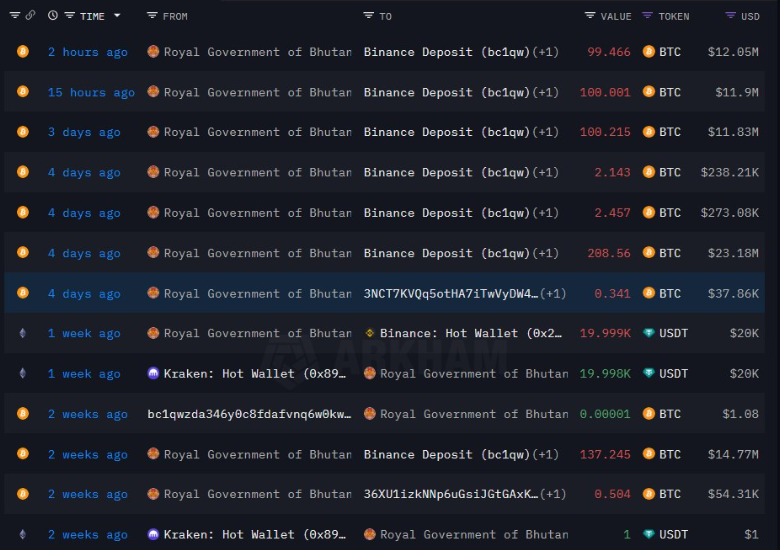

The Royal Government of Bhutan, through its sovereign investment arm Druk Holding & Investments (DHI), has moved over $74 million worth of Bitcoin (BTC) to Binance, coinciding with the cryptocurrency reaching new all-time highs.

Blockchain data from Arkham Intelligence and Onchain Lens shows that 650 BTC was transferred to Binance over a two-week period, with the most recent transaction involving 99.47 BTC (worth $12.05 million) taking place just hours after BTC surpassed $120,000.

Strategic Sell-Off as Bitcoin Surges

The initial transfer was recorded on June 30, when 137.24 BTC was moved while Bitcoin traded near $107,000, placing the value of that transaction at approximately $14.7 million. Subsequent transfers occurred in varying sizes, ranging from 2 BTC to 200 BTC, indicating a possible staggered exit strategy.

The timing of these transfers suggests the Bhutanese government is strategically cashing out part of its holdings to capitalize on current market highs.

At the time of writing, Bitcoin trades above $122,300, continuing a strong upward trend supported by ETF inflows and institutional adoption.

Bhutan’s Crypto Holdings and Onchain Footprint

Despite these recent outflows, Bhutan still holds a significant digital asset reserve:

- 11,411 BTC, valued at nearly $1.4 billion

- 656 ETH, worth approximately $2 million

These holdings make Bhutan one of the most prominent sovereign players in the crypto space, especially considering its relatively small economy.

A Government Embracing Bitcoin Innovation

Bhutan has taken a unique path by incorporating cryptocurrency into its national economic strategy. Under the guidance of King Jigme Khesar Namgyel Wangchuck, the country has adopted:

- Hydropower-based Bitcoin mining infrastructure

- A state-managed crypto reserve

- Collaborative initiatives with global crypto platforms like Binance

In May 2025, Bhutan partnered with Binance to enable crypto-based payment systems, aiming to modernize its financial infrastructure and expand access to digital finance across the region.

This forward-looking stance aligns Bhutan’s tech-driven development model with the decentralization and financial sovereignty offered by blockchain.

What’s Next?

Bhutan’s decision to liquidate a portion of its Bitcoin holdings comes at a time when crypto markets are at multi-year highs, and global institutions are ramping up BTC adoption.

As the world watches how nation-states interact with digital assets, Bhutan stands out as a model for sovereign crypto integration, balancing profit-taking with continued investment in blockchain-based infrastructure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.