Bitcoin Joins GameStop’s Balance Sheet in $500M Bet

GameStop has officially entered the Bitcoin arena, with CEO Ryan Cohen confirming that the company acquired 4,710 BTC on May 28, 2025, worth over $500 million at the time. According to Cohen, this move isn’t about following in MicroStrategy’s footsteps but instead reflects a unique inflation-hedging strategy amid global monetary uncertainty.

“We have our own strategy,” Cohen stated. “We’re focused on deploying capital responsibly and protecting value for our shareholders.”

GameStop now holds one of the largest corporate BTC treasuries in the U.S., positioning itself alongside major firms leveraging crypto to offset fiat debasement.

Crypto Payments May Soon Be Accepted for Trading Cards

In a recent CNBC interview, Cohen also revealed that GameStop is exploring accepting cryptocurrency as a payment method, particularly for its trading cards and collectibles segment.

“There’s definitely an opportunity to buy trading cards using crypto,” he said. “We’re going to look at all cryptocurrencies.”

While no specific token has been named, Cohen emphasized that utility-driven use cases — not just investment — are essential to the company’s exploration of crypto payments.

A New Approach After Previous Crypto Retreats

GameStop’s interest in crypto isn’t new. The company launched and later shut down both its NFT marketplace (January 2024) and crypto wallet (November 2023), citing regulatory uncertainty. However, the tone now suggests a more measured and long-term approach, particularly focused on Bitcoin and functional use cases within GameStop’s core business model.

Strong Financials Back the Strategy

With a $9 billion cash and securities position and a recently completed $450 million raise from a $2.25 billion private convertible note offering, GameStop has ample liquidity to diversify its treasury holdings.

Cohen added, “We’re looking for opportunities where the downside is limited and the upside is meaningful.”

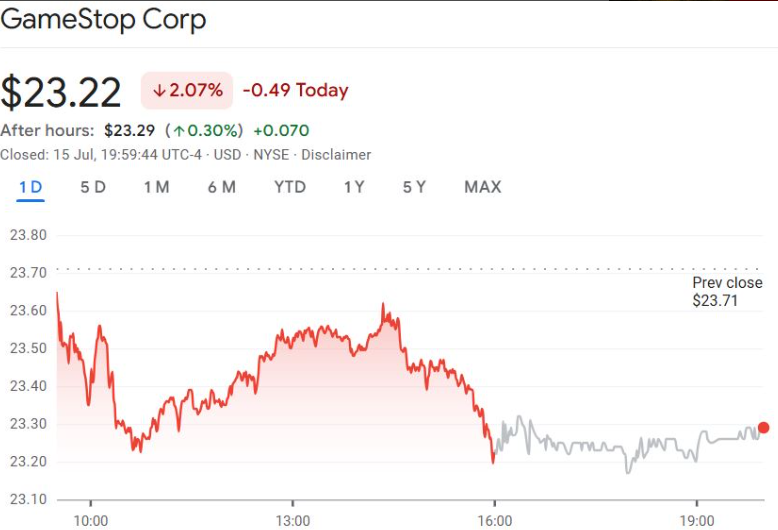

Market Reaction Mixed Despite Bold Crypto Moves

Despite the announcement, GameStop stock (GME) ended the day down 2.5% at $23.22, with a mild after-hours rise to $23.29. The market appears cautious, perhaps waiting for more concrete action or adoption metrics tied to crypto initiatives.

That said, shares had jumped 30% in the 30 days leading up to the Bitcoin purchase, signaling investor optimism prior to the June pullback.

Outlook

With Bitcoin on the balance sheet and crypto payment options under consideration, GameStop is positioning itself at the intersection of retail, collectibles, and digital assets. As regulatory clarity improves and consumer demand evolves, the company’s renewed crypto focus could define the next phase of its turnaround story.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.