Security Breach Hits Hot Wallets; Investigations Underway

On July 16, 2025, crypto exchange BigONE confirmed a $27 million breach, caused by a targeted attack on its hot wallet infrastructure. Despite the severity of the exploit, the platform has pledged full compensation to affected users, assuring that all customer balances remain secure.

According to BigONE’s official statement, the breach was detected swiftly following abnormal withdrawal activity. The exploit was isolated, with no compromise to cold wallets or private keys. Operations have been partially restored, with deposits and trading set to resume within hours, while withdrawals remain temporarily suspended to enhance security protocols.

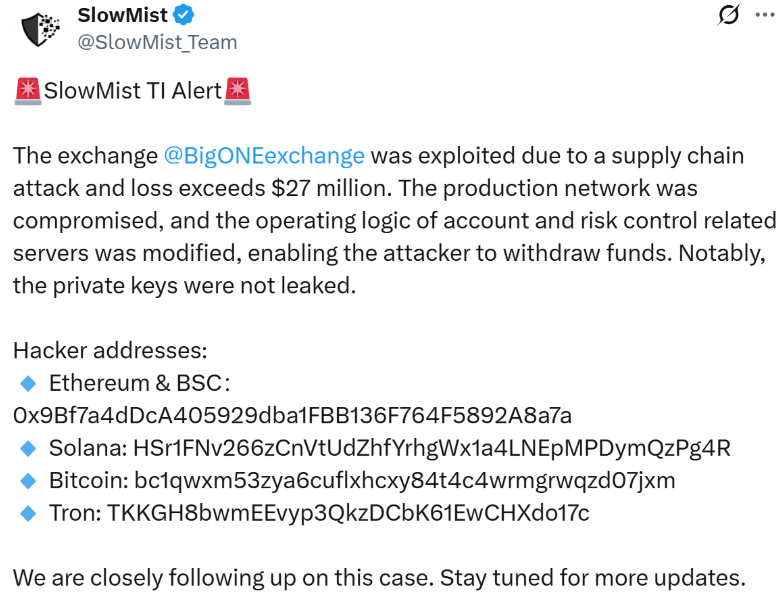

SlowMist Assists in Blockchain-Based Forensics

To track and recover the stolen assets, BigONE has partnered with blockchain security firm SlowMist. Fund tracing is currently in progress across Bitcoin, Ethereum, Tron, Solana, and BNB Chain. The stolen assets include:

- 120 BTC

- 350 ETH

- 9.5 billion SHIB

- 7.1 million USDT (multi-chain)

- 538,000 DOGE

- 1,800 SOL

- 1 WBTC

- 20,730 XIN

- 15.7 million CELR

- 25,487 UNI

- 16,071 LEO

The exchange has committed to restoring liquidity using a combination of internal reserves and external capital, especially for less liquid tokens.

User Funds Will Be Fully Covered

BigONE emphasized that no user will bear losses from the incident. Compensation will be issued in the same assets where possible, or in equivalents pegged to the market value at the time of the breach.

“We sincerely apologize for the inconvenience,” the BigONE team said in a statement. “Transparency remains our top priority, and we will provide real-time updates on the investigation.”

Rising Industry Concern Over Exchange Exploits

This latest breach adds to a growing list of crypto exchange hacks in 2025, with total exploit losses now exceeding $2.1 billion. Security experts are calling for stricter risk controls, particularly for platforms managing large sums in hot wallets.

As blockchain forensics continue and regulatory pressure mounts, this event may further intensify calls for industry-wide standards in wallet security and multi-chain transaction monitoring.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.