From Bitcoin Mining to AI Infrastructure: Hive’s Strategic Evolution

Hive Digital Technologies (HIVE) is taking a bold step beyond cryptocurrency mining with a major expansion into high-performance computing (HPC). The company is targeting a $100 million annual revenue run rate from its AI-driven HPC business by 2026 — a transformation that reflects its long-term pivot toward artificial intelligence infrastructure.

Hive was one of the first publicly traded miners to move into HPC back in 2022.

The company initially started with just 400 GPUs managed by two employees. Today, it is scaling up with powerful Nvidia H100 and Blackwell chips, aligning with the global AI boom and demand for compute power.

AI Seen as More Profitable Than Bitcoin Per Kilowatt

According to Executive Chairman Frank Holmes and CEO Aydin Kilic, the company recognized that AI workloads generate more value per kilowatt-hour compared to traditional Bitcoin mining, especially after the 2024 Bitcoin halving that reduced block rewards.

Hive reported $20 million in HPC revenue in 2023 and aims to scale that fivefold.

Despite diversifying, Hive continues to maintain positive gross mining margins, even during Bitcoin’s downturn in 2022, citing its efficient infrastructure, with energy usage as low as 17.5 J/TH.

New Facility Near Toronto to Boost AI Capacity

To support growth, Hive acquired a new facility near Toronto’s Pearson International Airport, with potential to scale up to 7.2 megawatts of HPC capacity. The site offers proximity to Canada’s leading AI research ecosystem, including the University of Toronto.

This location strategically places Hive in one of North America’s most talent-rich AI hubs.

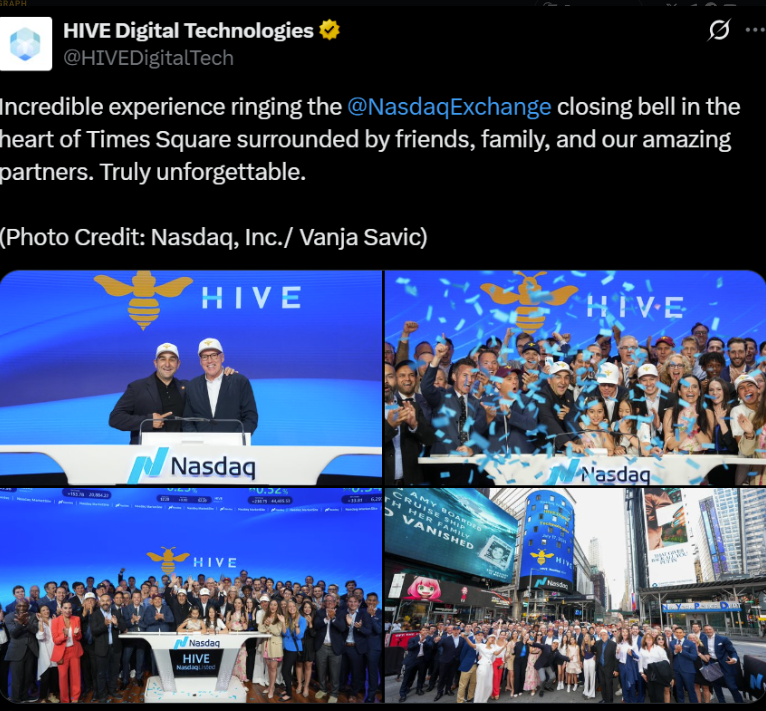

Market Valuation Trails Despite Growth

While Hive has rebranded around AI and HPC, its stock still trades like a Bitcoin proxy, limiting investor upside. Shares recently rose 31% in the past month but remain down 27% year-to-date, trading near $2.23, with a market cap of about $475 million.

Analysts remain bullish. H.C. Wainwright issued a $10 price target, while Canaccord Genuity maintained a $9 target, both citing undervaluation.

Expanding Internationally with Focus on Paraguay

Hive is also growing globally, having acquired a large Paraguay facility for $85 million earlier this year. The site offers low-cost hydropower, political stability, and government support — key factors in sustaining long-term AI and crypto operations.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.