Nearly 1 Million SOL: A Strategic Treasury Milestone

DeFi Development Corp, a Nasdaq-listed firm, has taken its Solana holdings to 999,999 SOL after a recent acquisition worth $198 million. This makes the company one of the largest known corporate holders of Solana (SOL), a bold move that is closely tied to its long-term treasury growth strategy.

The firm acquired 141,383 SOL between July 14 and 20 through spot purchases, locked discounts, and staking rewards.

According to their Monday statement, the treasury is being actively staked, generating native yield while reinforcing the security of the Solana blockchain.

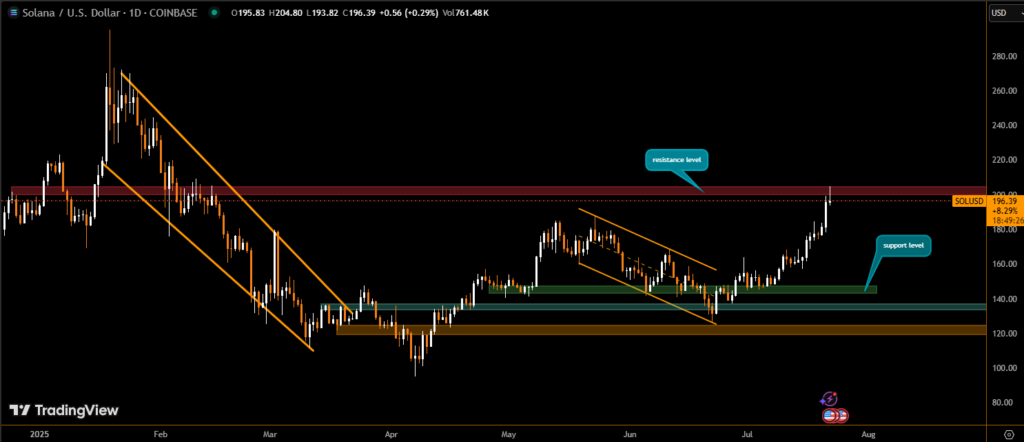

Solana Crosses $200 With 12% Daily Surge

Shortly after DeFi Development Corp’s latest buy, Solana’s price surged 12%, reaching over $202, according to data from Nansen. Over the past seven days, SOL is up more than 25%, outperforming most major cryptocurrencies.

Solana’s strong price momentum has quickly validated the firm’s latest treasury move.

Despite this rally, DeFi Development Corp’s own stock fell 3.65% on Monday to $23.52, though it rebounded after-hours to $24.55. The company stated that it still has $5 million available for additional SOL purchases — which could net approximately 24,752 more tokens at current prices.

Why Solana? CEO Explains the Strategy

In a recent podcast, CEO Joseph Onorati reaffirmed that DeFi Development Corp has no plans to diversify into other digital assets.

“Solana offers both volatility and native yield — two key ingredients that support convertible debt financing and maximize shareholder value,” Onorati explained.

This treasury-focused approach mirrors strategies used by other publicly traded firms to capitalize on token volatility through equity raises and structured finance.

Solana Adoption by Other Public Companies

DeFi Development Corp isn’t alone in building a Solana treasury. On July 10, Bit Mining announced plans to raise $300 million for its own Solana strategy. And back on June 16, MemeStrategy, a Hong Kong-listed firm, made headlines with its purchase of 2,440 SOL, marking the first corporate Solana investment on the HKEX.

The momentum indicates rising institutional confidence in Solana’s long-term value.

Final Thoughts

With 999,999 SOL staked and millions ready for further purchases, DeFi Development Corp has positioned itself as a major force within the Solana ecosystem. As corporate Solana adoption accelerates, all eyes are on how these strategic treasuries will shape both market behavior and shareholder returns.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.