State-managed portfolio increases stake in BTC-linked firms amid growing institutional adoption

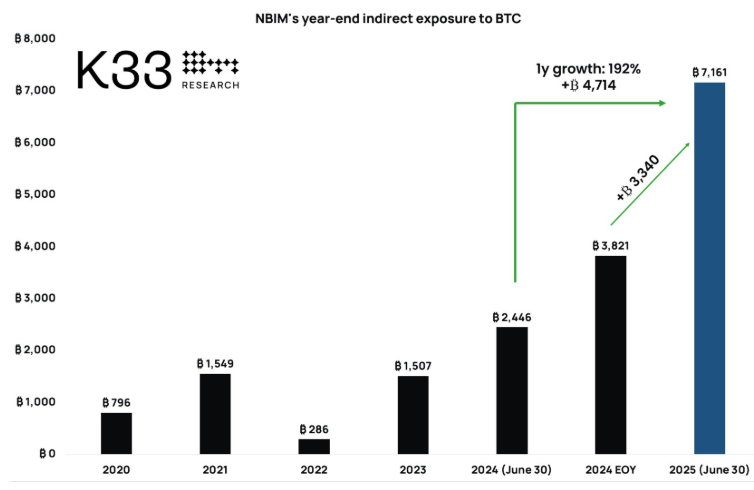

Norway’s sovereign wealth fund, the world’s largest state-managed investment vehicle, has significantly increased its indirect Bitcoin exposure in 2025, marking a 192% year-on-year rise, according to data from K33 Research.

The fund now holds exposure to 7,161 BTC through investments in crypto-linked companies, including treasury firms Strategy and Metaplanet, as well as cryptocurrency exchange Coinbase. This exposure comes despite the fund’s mandate prohibiting direct cryptocurrency holdings, forcing managers to use corporate proxies and publicly traded companies as alternative vehicles.

Over the past year, the fund increased its stake in Strategy’s stock by 133% to over 11.9 billion Norwegian krone ($1.2 billion). Its position in Coinbase also surged 96% during the same period. Analysts view these moves as part of a broader trend among sovereign wealth funds seeking exposure to Bitcoin without breaching traditional asset allocation rules.

The approach mirrors strategies used by other major funds worldwide. For example, the State of Wisconsin Investment Board doubled its Bitcoin ETF holdings to $321 million earlier this year before trimming back to a $50 million position in Strategy. Similarly, Kazakhstan’s sovereign wealth fund revealed plans to convert a portion of its reserves—including gold and foreign currency—into crypto assets to enhance returns.

Norway’s move underscores the growing acceptance of Bitcoin as part of diversified state-level portfolios, even if held indirectly. With institutional adoption accelerating, such strategies could pave the way for more government-backed funds to enter the crypto market through regulated channels rather than direct spot purchases.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.