Institutional demand drives growth in tokenized funds and indexes

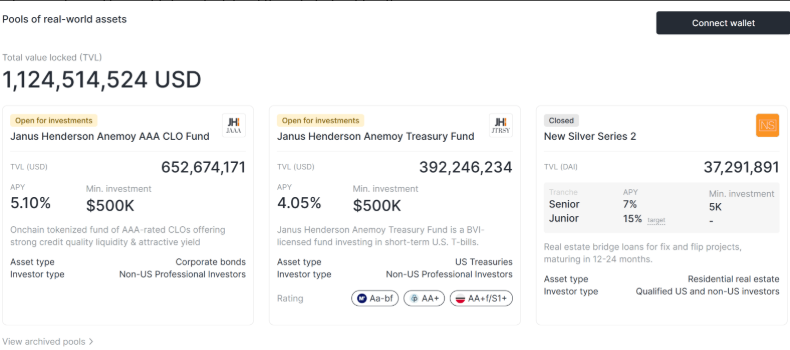

Centrifuge has crossed $1 billion in total value locked (TVL), joining BlackRock’s BUIDL and Ondo Finance in the exclusive club of real-world asset (RWA) platforms exceeding the milestone. The achievement reflects the accelerating shift of institutions from pilot projects to large-scale adoption of tokenized financial products.

Centrifuge CEO Bhaji Illuminati attributed the growth to this institutional pivot and to the rise of onchain allocator activity. “Markets need more than T-bills,” he explained, highlighting the success of JAAA — an onchain version of Janus Henderson’s AAA-rated collateralized loan obligation (CLO) fund. According to Illuminati, JAAA is currently the fastest-growing tokenized fund in the segment, while U.S. Treasurys remain the most common entry point for institutional allocators.

Rising demand for tokenized indexes

In July, Centrifuge introduced a tokenized S&P 500 product in partnership with S&P Dow Jones Indices. Structured as a regulated professional fund in the British Virgin Islands, the product has already attracted “very strong” demand ahead of its full rollout. An anchor pool of capital will back the launch, ensuring wide accessibility from day one.

Illuminati noted that this is just the start. “We see strong potential for sector and thematic index products to come onchain next,” he said, signaling that traditional indexes may soon have blockchain-native counterparts.

Beyond institutional products, Centrifuge plans to extend tokenized asset access to retail users through the deRWA initiative, designed to integrate RWAs into exchanges, wallets, lending protocols, and broader DeFi ecosystems. The initiative focuses on composability and liquidity, making tokenized assets usable across decentralized finance platforms.

S&P Dow Jones Indices is also in talks with exchanges and custodians to bring tokenized versions of its benchmarks onchain. Stephanie Rowton, director of U.S. equities at S&P DJI, said partnerships will “enhance the investor experience by building infrastructure that supports trading and accessibility of tokenized indexes.”

In the near term, public market RWAs such as Treasurys and equities are expected to dominate adoption due to their liquidity and familiarity. Longer term, Illuminati believes private credit and private markets will unlock greater value, as blockchain technology reduces inefficiencies and opens new yield opportunities.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.