Trump family’s DeFi project, World Liberty Financial (WLFI), has minted $205 million worth of its USD1 stablecoin, boosting its total supply to $2.4 billion — a major leap that positions USD1 among the top stablecoins globally.

The minting, announced on Thursday via X (formerly Twitter), comes as USD1’s circulating supply hit an all-time high. This increase follows a period of stability since late April, signaling renewed momentum for the stablecoin.

Launched in early April, USD1 has quickly risen to become the sixth-largest stablecoin by market capitalization, trailing behind giants like Tether (USDT), which dominates with a $167 billion market cap and Circle’s USDC, holding $67.4 billion.

Pro-Stablecoin Sentiment Fuels Growth

The minting occurred hours after Federal Reserve Governor Christopher Waller delivered a pro-crypto speech at a blockchain conference in Wyoming. Waller emphasized:

“Stablecoins have the potential to maintain and extend the role of the dollar internationally.”

He also highlighted their role in enhancing retail and cross-border payments, while praising the GENIUS Act, a recent law aimed at regulating and supporting the stablecoin market. Waller’s comments align with SEC Chair Paul Atkins, who recently called the bill a “seminal step for the U.S. Congress and government.”

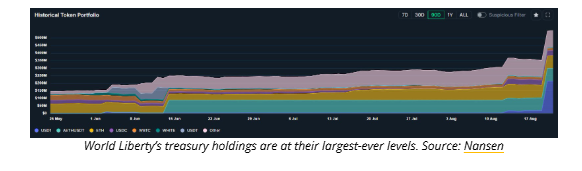

WLFI Treasury Reaches $548 Million

The latest mint has pushed World Liberty’s treasury holdings to $548 million, marking its highest level ever. According to Nansen data:

- USD1 is now the largest holding, worth $212 million (39%) of the portfolio.

- WLFI also holds 19,650 ETH (valued at $85 million) and Aave-based USDT investments.

Earlier reports suggest WLFI is considering launching a publicly traded entity to hold its tokens, targeting $1.5 billion in fundraising.

The Trump-backed WLFI project is emerging as a significant player in the stablecoin space, especially as regulatory clarity improves through laws like the GENIUS Act. If adoption continues and partnerships grow, USD1 could challenge established players in the coming months.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.