Chainalysis 2025 Global Adoption Index highlights shifting market dynamics

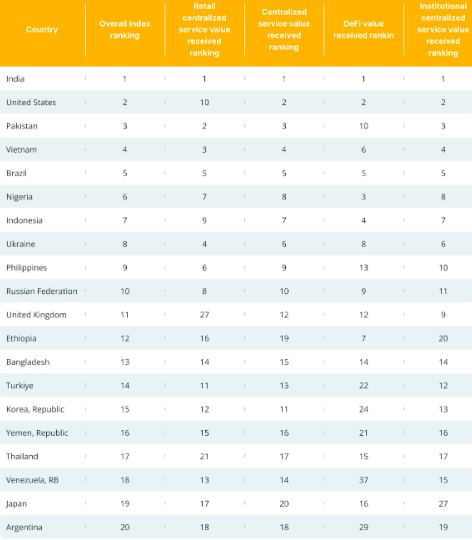

The United States has risen to second place in global crypto adoption, according to the 2025 Global Adoption Index by Chainalysis. The move up two spots reflects the impact of exchange-traded funds (ETFs), institutional inflows, and regulatory clarity.

India retained the top spot for the third consecutive year, supported by remittance demand, grassroots adoption, and a large tech-savvy population. Meanwhile, Pakistan, Vietnam, and Brazil rounded out the top five, signaling a diverse adoption landscape across both emerging and mature markets.

Why adoption is accelerating

Chainalysis chief economist Kim Grauer explained that adoption is strongest in regions where crypto solves immediate, real-world problems:

“The biggest driver of this adoption is utility: whether it’s stablecoins used for remittances, savings in inflation-prone economies, or decentralized apps meeting local needs, people adopt crypto when it solves real problems.”

This trend is visible across emerging economies where stablecoins act as inflation hedges and in developed markets where regulation enables large-scale institutional participation.

US rise driven by ETFs and clearer regulation

The US climbed from fourth to second place, fueled by record ETF adoption. Spot Bitcoin ETFs, launched in January 2024, have attracted $54.5 billion in inflows, with most coming in the past year.

Institutional investors also embraced Ether ETFs, with investment advisers buying $1.3 billion and hedge funds adding $687 million in the second quarter of 2025, according to Bloomberg.

Regulatory clarity in Washington has been key, with clearer rules giving traditional finance players more confidence to enter the market. This has legitimized crypto as part of mainstream portfolios, driving adoption at both retail and institutional levels.

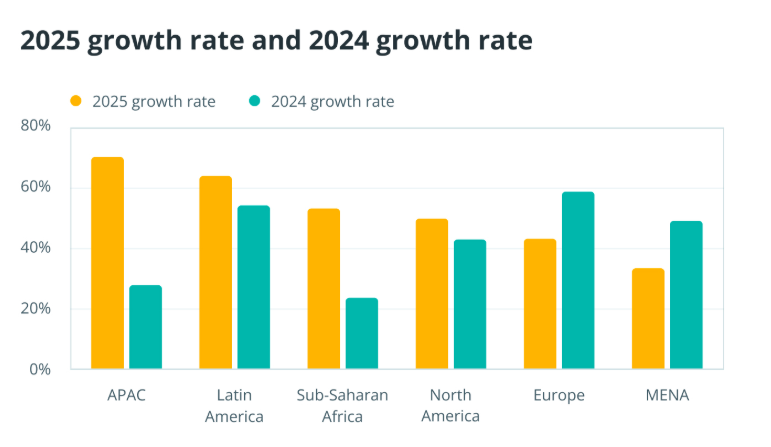

Asia-Pacific dominates global adoption growth

The Asia-Pacific (APAC) region saw the highest year-on-year growth, with crypto value received rising 69% to $2.36 trillion. India led the way, followed by Pakistan, Vietnam, the Philippines, South Korea, and Thailand, several of which ranked in the global top 20.

“Grassroots crypto adoption will tend to follow where these real-world needs exist and are pressing, even where regulatory conditions are not facilitative,” Grauer noted.

Latin America also showed resilience, with 10% annual growth and countries like Brazil and Argentina ranking in the top 20.

Eastern Europe dominates per-capita rankings

When measured on a per-capita basis, Ukraine, Moldova, and Georgia topped the adoption index, reflecting strong technical literacy, limited banking trust, and economic instability in the region. Countries like Latvia, Slovenia, and Belarus also ranked highly.

These conditions make crypto a practical alternative for wealth preservation and cross-border payments in regions affected by inflation, war, or restrictive banking systems.

Bitcoin remains the primary entry point

Chainalysis reported that Bitcoin accounted for more than $4.6 trillion in fiat inflows, far surpassing other assets. Layer 1 tokens (excluding BTC and ETH) followed with $4 trillion, while stablecoins reached just under $1 trillion.

The US led with $4.2 trillion in crypto on-ramps, followed by South Korea at $1 trillion. In the UK and EU, nearly half of fiat inflows went directly into Bitcoin, underscoring its dominance as a store of value.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.