Proposed rule changes raise entry barriers, giving stronger digital asset treasury firms an advantage

Nasdaq is moving to tighten its listing standards, a shift that could raise costs for shell companies and reshape how digital asset treasury (DAT) firms access public markets. While the changes are designed to improve compliance and strengthen market quality, they may also limit smaller players from using shell entities as a pathway into the crypto economy.

Key Proposed Changes

The proposed Nasdaq listing standards introduce three major updates:

- Minimum public float requirement lifted to $15 million for new listings.

- Faster delistings for companies with compliance deficiencies or a market value below $5 million.

- $25 million minimum public-offering proceeds for companies principally operating in China.

Nasdaq said it has submitted the proposed rules to the SEC for review and plans to implement them promptly if approved.

According to Brandon Ferrick, general counsel at Douro Labs, the new rules are not expected to hurt well-managed DATs. Instead, they could strengthen their market position.

“You can expect the best names to trade at a premium because the weaker performing firms will be washed out. This effectively puts an mNAV premium on high-quality DATs,” Ferrick explained.

Here, mNAV (multiple of net asset value) reflects how the market values a company relative to its digital asset holdings.

Rising Costs for Shell Companies

The $15 million float threshold may create new hurdles for shell entities, such as special purpose acquisition companies (SPACs), which have often been used in digital asset treasury deals.

Ferrick warned: “The shell companies will become more expensive […] which means that the barrier to entry was just raised.”

Shell companies are legal entities with little to no operations, commonly used in venture deals, asset management, or corporate restructuring. With higher float requirements and stricter delisting risks, the cost of bringing such entities to market could rise significantly.

Broader Market Context

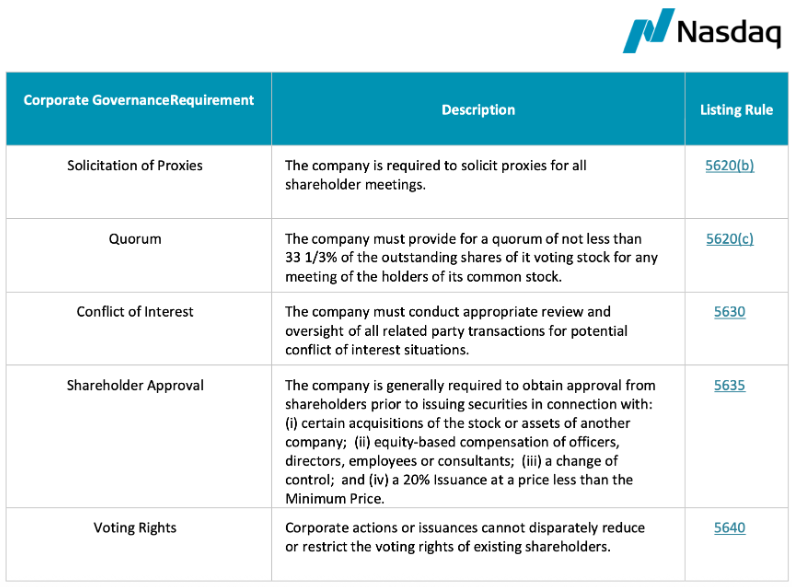

Nasdaq remains one of the largest stock exchanges globally, with 3,324 listed companies in the U.S. and handling more than 49 billion equity shares in monthly trading volume as of August 2025. The exchange’s governance rules already require shareholder approval for major acquisitions, equity compensation changes, or transactions involving 20% or more of shares below market price.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.