Cathie Wood’s ARK Invest has expanded its exposure to Ethereum by purchasing over 100,000 shares of BitMine Immersion Technologies (BMNR), the world’s largest corporate Ether treasury firm. The move comes as BitMine announced that its ETH holdings have surpassed the 2 million milestone, further solidifying its dominance in the institutional Ethereum landscape.

ARK Invest Expands BitMine Exposure

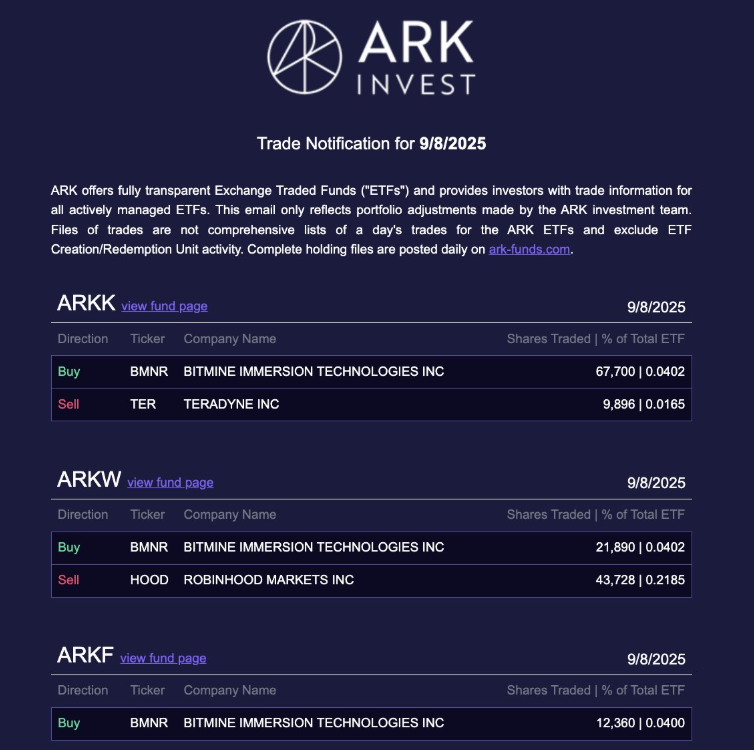

On Monday, ARK Invest acquired 101,950 BitMine shares worth around $4.4 million across three funds:

- ARK Innovation ETF – with a 2.6% allocation to BitMine

- ARK Next Generation Internet ETF

- ARK Fintech Innovation ETF

Combined, these funds now hold 6.7 million BitMine shares, valued at approximately $284 million. ARK has been steadily increasing its position since April 2025, when BitMine began aggressively accumulating Ethereum as a treasury reserve asset.

BitMine Hits 2 Million ETH Holdings

Alongside ARK’s purchase, BitMine revealed that its corporate treasury has surpassed 2 million ETH, worth nearly $8.9 billion.

- This represents 1.7% of Ethereum’s total circulating supply.

- BitMine controls 42% of the 4.9 million ETH currently held by corporations worldwide.

- The company is just 34% toward its long-term target of acquiring 5% of Ethereum’s total supply.

BitMine’s chairman Tom Lee described Ethereum as “one of the biggest macro trades over the next 10–15 years,” signaling that the firm will continue accumulating aggressively.

Market Impact on Stock and ETH

BitMine’s stock closed the day up 4.1% at $44.10 in after-hours trading, marking a 460% surge since the start of 2025. Meanwhile, Ether (ETH) is trading around $4,355, showing limited movement this month and remaining within a narrow range despite growing institutional adoption.

Tom Lee Bullish on Fed Rate Cuts

Tom Lee also weighed in on macroeconomic conditions, noting that a potential Federal Reserve interest rate cut could act as a dual catalyst:

- Lowering borrowing costs, particularly mortgage rates.

- Boosting overall business and investor confidence.

Futures markets currently price in an 89.4% chance of a 25 basis point cut, with a 10.6% chance of a 50 basis point cut. Lee believes such a move would provide tailwinds for equities, small-cap stocks, and cryptocurrencies like Ethereum.

The aggressive accumulation by BitMine highlights a growing trend of corporations using Ethereum as a reserve asset, much like Bitcoin has been adopted by firms such as MicroStrategy. With ARK Invest backing BitMine’s strategy, this development underscores the institutional shift toward Ethereum as a long-term store of value.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.