Ether treasury firm moves to boost NAV per share and investor confidence

Sharplink, the world’s second-largest Ether treasury company, has initiated a $1.5 billion share buyback program after its stock fell below its net asset value (NAV).

Strategic response to undervaluation

The company said on Tuesday that repurchasing stock priced under NAV is immediately accretive to shareholders. Sharplink co-CEO Joseph Chalom emphasized that maximizing stockholder value remains the top priority as the firm navigates market volatility.

“We believe the market currently undervalues our business,” Chalom said. “Rather than issue equity while trading below NAV, we are focused on disciplined capital allocation — including share repurchases — to increase stockholder value.”

The announcement follows remarks from NYDIG analysts urging crypto treasury companies to consider buybacks when their shares trade at a discount to NAV, warning that premiums across the sector are narrowing.

Early impact on share performance

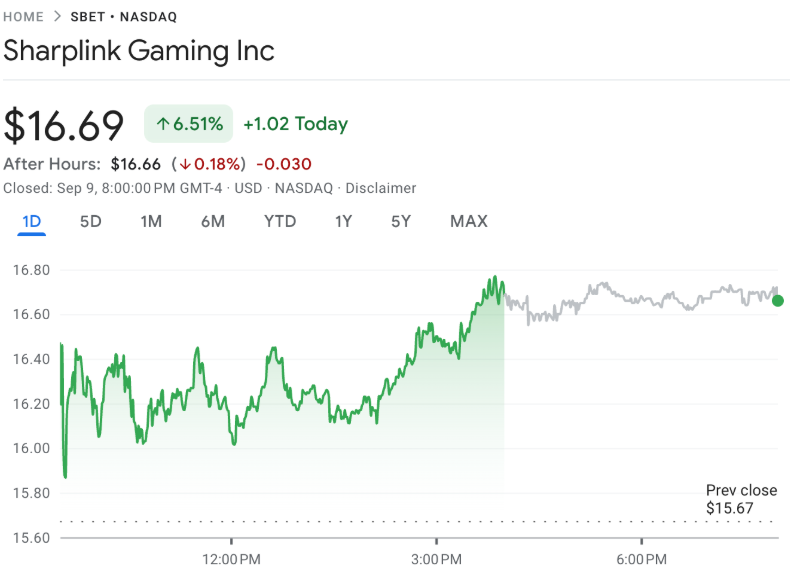

Sharplink began its buyback by repurchasing 939,000 common shares at an average price of $15.98. Shares (NASDAQ: SBET) responded positively, closing Wednesday at $16.69, up 6.59%.

Despite the recent bump, Sharplink’s stock remains down 25% over the past 30 days. The company said its buyback plan underscores confidence in its long-term strategy, describing the shares as “significantly undervalued.”

Massive Ether holdings support program

Sharplink currently holds 837,230 Ether (ETH), worth roughly $3.59 billion, according to StrategicETHReserve data. The firm noted that nearly all of its ETH is staked, generating ongoing revenue through blockchain rewards.

The buyback program, authorized on August 22, allows the company to act quickly in market conditions where its stock trades at a discount to NAV.

Industry analysts back buyback approach

Greg Cipolaro, global head of research at NYDIG, recently stated that if digital asset treasury (DAT) companies trade below NAV, “the most straightforward course of action would be stock buybacks.”

He added that firms should set aside funds specifically for supporting share prices via repurchase programs to avoid long-term valuation risks.

The move aligns with broader market commentary suggesting that only a handful of crypto treasury companies will survive long term, particularly those with disciplined financial strategies and strong asset backing.

By leveraging its multi-billion-dollar ETH reserves, Sharplink aims to reassure investors and realign its stock price closer to its asset value.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.