Spot Ether ETFs also rebound with three straight days of inflows ahead of Fed decision

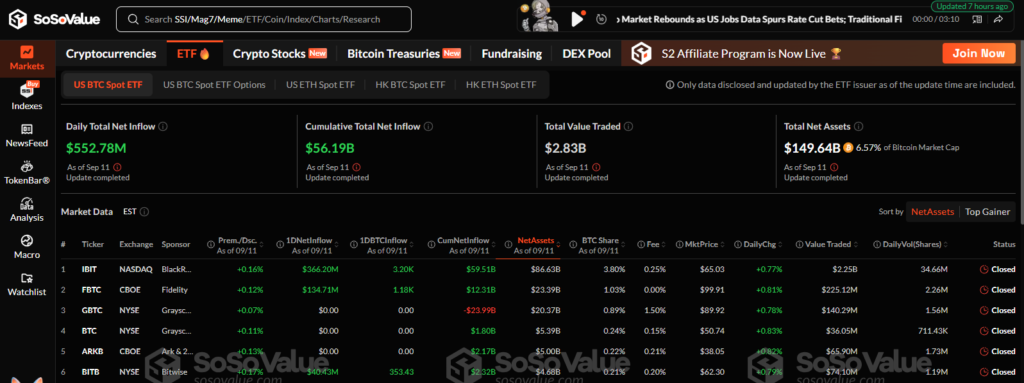

Bitcoin exchange-traded funds (ETFs) in the U.S. recorded $552.78 million in inflows on Thursday, marking their fourth consecutive day of gains, according to data from SoSoValue. This streak is the joint-longest since mid-August, when Bitcoin surged to its all-time high above $123,000.

Bitcoin ETF inflows match August rally momentum

The current four-day run matches a similar stretch that ended on Aug. 28 and trails only the seven-day inflow streak in mid-August, which coincided with Bitcoin’s historic rally. Wednesday’s inflow of $757.14 million was the largest single-day addition since July 16.

Analysts note that institutional demand remains robust as ETF flows continue to serve as a key indicator of market confidence.

Spot Ether ETFs rebound after billion-dollar outflows

Alongside Bitcoin’s momentum, spot Ether (ETH) ETFs have recorded three straight days of inflows following a period of weakness. Last week, Ether funds saw six consecutive days of outflows, totaling over $1 billion withdrawn.

The turnaround suggests renewed investor interest in Ethereum, particularly as anticipation builds around potential network upgrades and regulatory clarity.

Federal Reserve decision in focus

Both Bitcoin and Ether rallied in the latter half of the week, supported by expectations of a U.S. Federal Reserve interest rate cut on Sept. 17. Market watchers believe that looser monetary policy could provide further upside for risk assets, including cryptocurrencies.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.