Fidelity and BlackRock lead the charge as crypto ETFs see strong inflows

Institutional appetite for crypto exposure is on the rise as spot Bitcoin and Ether ETFs logged significant inflows on Friday, marking a clear resurgence of confidence in digital assets.

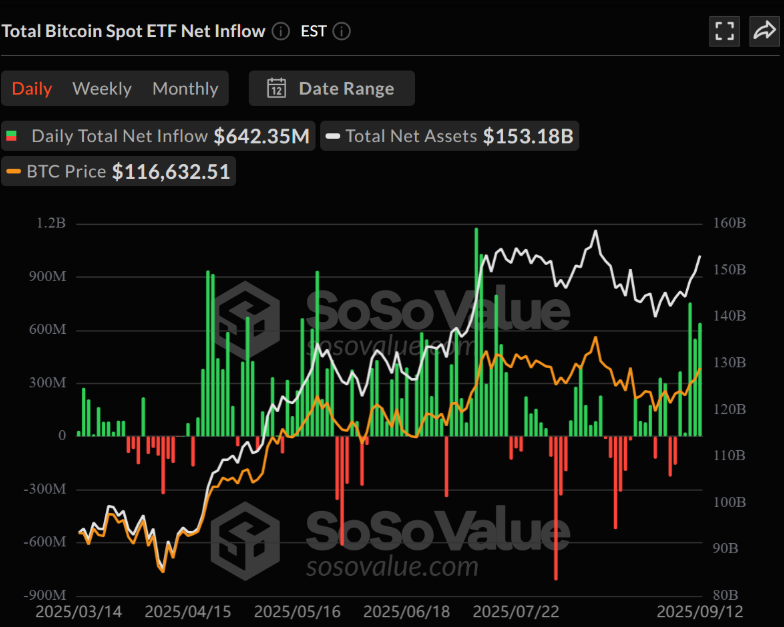

Bitcoin ETFs record $642 million in inflows

Spot Bitcoin ETFs brought in $642.35 million in net inflows, according to SoSoValue, marking the fifth straight day of gains. This pushed cumulative inflows to $56.83 billion, with total net assets hitting $153.18 billion, equivalent to 6.62% of Bitcoin’s total market cap.

Leading the surge, Fidelity’s FBTC secured $315.18 million in fresh capital, while BlackRock’s IBIT followed closely with $264.71 million. Daily trading volumes across all spot Bitcoin ETFs surpassed $3.89 billion, reflecting strong institutional activity. Both IBIT and FBTC also recorded daily gains of over 2%.

The spike in inflows follows a slower start to the month, with analysts suggesting that stabilizing macroeconomic conditions and improved sentiment are driving renewed interest.

Ether ETFs add $405 million

Spot Ether ETFs mirrored the momentum, attracting $405.55 million in net inflows on Friday, their fourth consecutive day of gains. Total inflows into Ether ETFs now stand at $13.36 billion, with net assets at $30.35 billion.

BlackRock’s ETHA brought in $165.56 million, while Fidelity’s FETH closely followed with $168.23 million. ETHA alone recorded $1.86 billion in trading volume, underscoring growing institutional interest in Ethereum-based investment products.

“Bitcoin and Ethereum spot ETFs keep seeing strong inflows, showing rising institutional confidence,” said Vincent Liu, CIO of Kronos Research. “If macro conditions hold, this surge could strengthen liquidity and drive momentum for both assets.”

BlackRock explores ETF tokenization

In addition to strong ETF performance, BlackRock is reportedly examining the tokenization of ETFs on blockchain networks, building on the success of its spot Bitcoin products. Such a move could further integrate traditional finance with blockchain infrastructure.

The sustained inflows into Bitcoin and Ether ETFs signal a broader shift in institutional strategy, with major asset managers doubling down on digital assets as part of diversified portfolios. If the trend continues, it may further cement crypto ETFs as a cornerstone of mainstream market exposure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.