France’s financial regulator has signaled it may take drastic steps to block crypto firms licensed in other EU countries from operating domestically, citing fears that uneven enforcement of the Markets in Crypto-Assets (MiCA) framework could weaken investor protection across Europe.

AMF Raises Alarm on Enforcement Gaps

The Autorité des Marchés Financiers (AMF) told Reuters that it is closely monitoring how different member states apply MiCA, which came into effect for crypto-asset service providers in December 2024.

“We do not exclude the possibility of refusing the EU passport,” said Marie-Anne Barbat-Layani, chair of the AMF. She described the move as “very complex,” even likening it to deploying an “atomic weapon” in regulatory terms.

Under MiCA, crypto companies licensed in one EU nation can operate across the 27-member bloc through a single authorization — a mechanism known as passporting. France fears that some firms may exploit this by securing approval in jurisdictions with weaker oversight, then expanding into larger markets with limited scrutiny.

France, Austria, and Italy Push for ESMA Oversight

France’s concerns are echoed by Austria and Italy, both of which have joined Paris in calling for the European Securities and Markets Authority (ESMA) to directly supervise major crypto firms. A joint position paper also urged tougher MiCA rules, including stricter requirements for non-EU activities, enhanced cybersecurity oversight, and a reassessment of new token offerings.

Analysts suggest that moving oversight to ESMA could help ensure uniform enforcement and limit regulatory arbitrage across Europe’s crypto sector.

Spotlight on Malta’s Licensing Regime

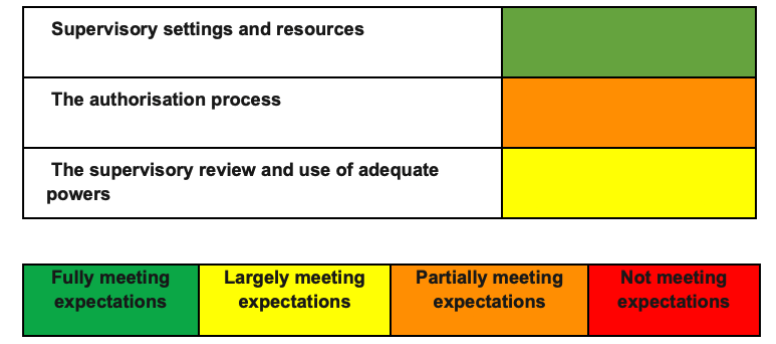

The debate follows recent criticism of Malta’s approach to crypto oversight. In July, ESMA’s Peer Review Committee found that the Malta Financial Services Authority (MFSA) only “partially met expectations” when authorizing a crypto provider. The report warned that pending material issues were not adequately addressed and urged the MFSA to tighten its supervisory practices.

France’s warning underscores growing tensions within the EU as MiCA transitions from law to enforcement. While the regulation aims to provide clarity and stability for Europe’s crypto industry, inconsistent application could create loopholes that undermine both investor confidence and market integrity.

As Europe seeks to become a global hub for digital assets, the balance between fostering innovation and ensuring accountability will likely determine whether MiCA succeeds as the blueprint for crypto regulation worldwide.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.