Japanese lender teams up with DeCurret and Partior to develop a blockchain-based settlement system

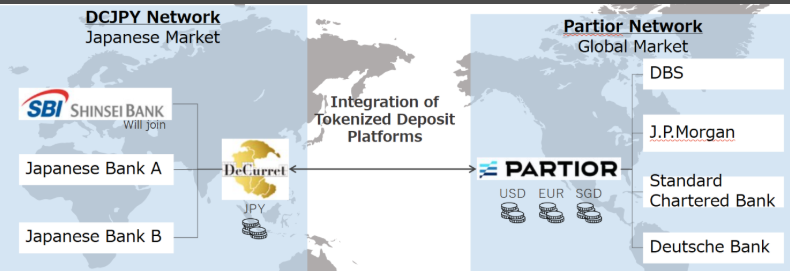

SBI Shinsei Bank has signed a new partnership with DeCurret DCP and Singapore-based Partior to explore tokenized deposits for cross-border transactions. The collaboration, announced this week, aims to build a blockchain-powered settlement framework that can handle payments in Japanese yen and other major currencies.

Tokenized Deposits and Cross-Border Efficiency

DeCurret currently runs the DCJPY platform, which allows local banks to issue yen-based tokenized deposits. Under this initiative, SBI Shinsei will expand beyond yen to include US dollars, euros, and other widely used currencies.

Partior, which operates a multicurrency settlement network already used by global players such as JP Morgan, DBS, Deutsche Bank, and Standard Chartered, will integrate Japanese yen into its infrastructure.

“The three companies will soon begin discussions to define detailed roles and responsibilities,” the partners said in their joint statement. The system is envisioned as a 24/7 settlement network that reduces costs and eliminates delays compared to traditional correspondent banking.

Alternative to Traditional Banking Rails

The collaboration targets the inefficiencies of current cross-border payments, where transactions often pass through multiple intermediaries. By using distributed ledger technology (DLT), the system aims to provide real-time clearing while cutting reliance on conventional correspondent banking channels.

Industry analysts suggest that if the model succeeds, it could serve as a blueprint for tokenized financial infrastructure in Asia and beyond.

Global Push for Tokenized Finance

This initiative follows the Bank for International Settlements’ “Project Agora”, which is working with central banks worldwide to connect tokenized commercial bank deposits with wholesale central bank money through a unified ledger. Similarly, Singapore’s Project Guardian, led by the Monetary Authority of Singapore (MAS), is testing tokenization in lending, securities, and foreign exchange markets.

By linking domestic platforms like DCJPY with Partior’s international settlement network, SBI Shinsei Bank is positioning itself at the forefront of tokenized cross-border payments. The move reflects a growing trend where financial institutions are shifting from experimental pilots to real-world blockchain integration, signaling a major transformation in global settlement systems.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.