BTC.D stabilizes near 58% after testing major demand zone

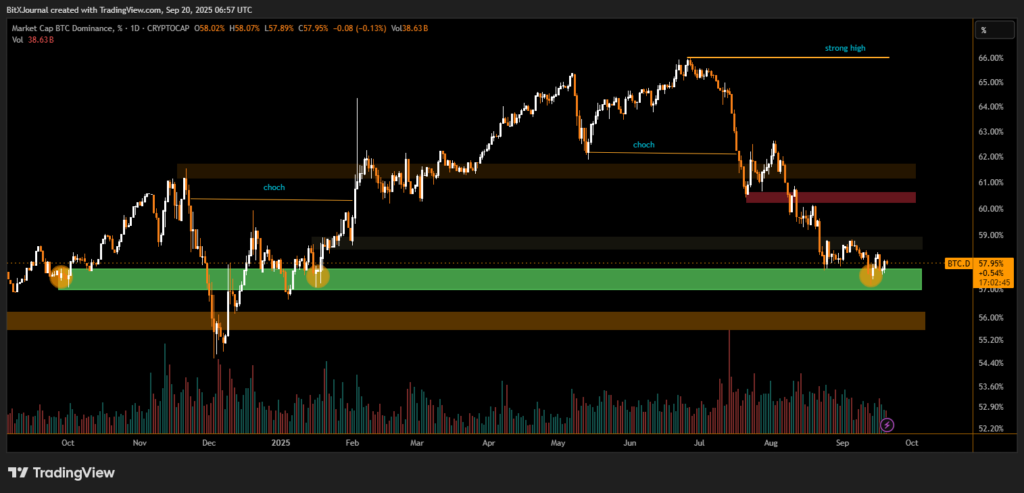

Bitcoin dominance (BTC.D), which tracks Bitcoin’s share of the overall crypto market capitalization, is currently hovering around 57.9%, showing signs of stabilization after testing a strong demand zone highlighted on recent technical charts.

The chart indicates that Bitcoin dominance has rebounded multiple times from the 57% support region, marked in green. This level has historically served as a strong base where buyers defend against further downside. Analysts note that holding this level could signal renewed strength for Bitcoin relative to altcoins.

“The 57% dominance area remains a crucial support,” BITX market strategist explained. “If Bitcoin holds above this zone, it could regain momentum, potentially challenging the 60%–62% resistance levels in the coming weeks.”

The recent bounce from this demand zone coincides with higher trading volumes, suggesting that institutional and retail investors are closely watching this level for directional cues.

Above the current price, resistance bands are clustered between 60% and 62%, with a prior “change of character” (choch) noted in this zone. A breakout beyond these levels would mark a significant shift in market structure, potentially driving Bitcoin dominance toward its previous strong high near 66%.

Failure to clear resistance, however, could invite renewed pressure and a retest of deeper supports closer to 55%, a level not seen since late 2024.

The dominance chart carries major implications for the broader crypto market. If Bitcoin dominance rises, altcoins may struggle to outperform, as capital rotates back into BTC. Conversely, a breakdown below the green demand zone could set the stage for an extended altcoin season, where smaller-cap tokens capture a larger share of market flows.

For now, Bitcoin dominance remains in a consolidation phase between 57% and 60%, with traders awaiting a decisive move. As one analyst summarized:

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.