ETH pulls back sharply, analysts highlight critical demand zone

Ethereum (ETH) is facing heightened volatility after dropping to test the $4,000 support level, a zone that traders consider vital for sustaining its recent bullish momentum. The move marks one of ETH’s most significant retracements in weeks, sparking debate on whether buyers can defend this critical price region.

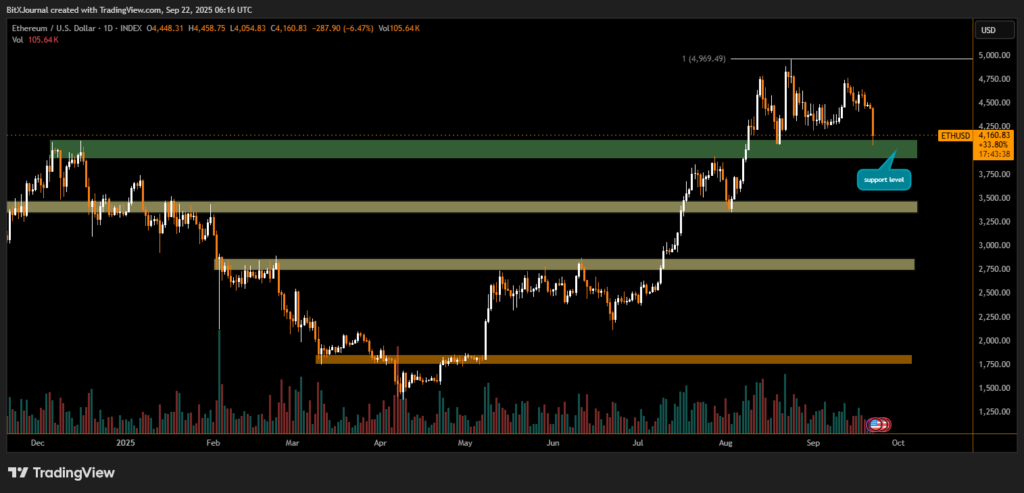

The daily chart shows ETH retreating from recent highs near $4,800–$4,900, slipping into a deeper correction phase. The decline has now brought the asset directly into the $4,000–$4,150 demand zone, a level that acted as both resistance and support in past cycles.

This area is underlined as a crucial pivot point for Ethereum. A successful defense could provide the base for a rebound back toward $4,500 and $4,800, while failure to hold may trigger a more extended correction toward $3,500–$3,600, the next major support zone highlighted on the chart.

Market observers emphasize the importance of this technical level. BITX strategist explained, “Ethereum’s structure remains bullish as long as it holds above $4,000. Losing this level, however, could open the door to a much broader correction.”

BITX analyst noted, “The $4,000 area is not just a psychological round number but also a high-volume support level. Traders will be closely watching the daily closes to gauge whether buyers can maintain control.”

Ethereum’s test of support near $4,000 underscores the fragile balance between bullish optimism and bearish pressure. While the asset still trades significantly above its summer lows, short-term sentiment will likely hinge on whether this demand zone attracts enough buying activity to stabilize price action.

For now, the $4,000 support remains the key battleground. A strong defense could signal renewed strength, while a break below may shift the outlook to a more cautious stance. With volatility intensifying, traders and investors alike are keeping a close eye on Ethereum’s next decisive move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.