New dollar-backed token sees rapid adoption, with majority deployed on Linea

MetaMask’s newly launched mUSD stablecoin has surpassed $65 million in circulating supply just one week after its debut, signaling strong early adoption in the increasingly competitive stablecoin market.

The stablecoin officially went live last Monday and has since expanded from an initial $15 million supply to more than four times that figure, according to data on MetaMask’s website.

Adoption Led by Linea

According to Dune Analytics data compiled by Seoul Data Labs, the majority of mUSD has been deployed on Linea (88.2%), while the remaining 11.8% is on Ethereum, reflecting early demand for multi-chain usage.

MetaMask has positioned mUSD as a fully backed, dollar-pegged stablecoin, issued through Bridge, Stripe’s stablecoin platform, and minted using M0’s decentralized infrastructure. The company emphasized that each unit is secured 1:1 with high-quality, liquid dollar-equivalent assets, underscoring transparency and security as differentiators.

Growing Stablecoin Sector

The rise of mUSD comes amid heightened focus on stablecoins following the passage of the U.S. GENIUS Act in July, which set out a regulatory framework for dollar-pegged digital assets. Just last week, the U.S. Treasury Department began seeking public feedback on its implementation of the law.

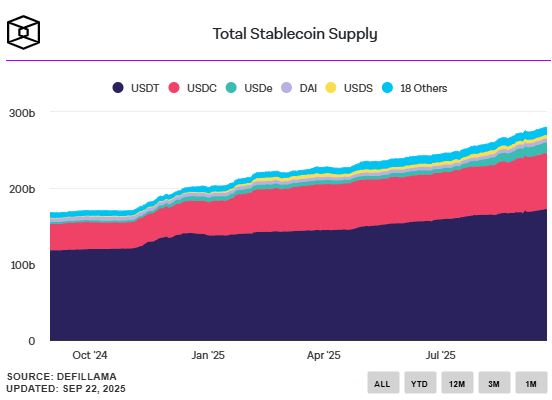

The wider market for stablecoins remains robust. As of Sunday, the total U.S. dollar-pegged supply reached $279.8 billion, led by Tether (USDT) with $172.3 billion in circulation. This suggests room for new entrants like mUSD to carve out market share, especially as competition heats up among blockchain platforms and payment providers.

Expanding Ecosystem

In parallel with MetaMask’s launch, other firms are making stablecoins a central part of their strategies. Kaia and LINE NEXT recently announced plans to introduce a stablecoin superapp on LINE’s Dapp Portal later this year, highlighting the trend toward integrated platforms.

With its rapid growth, mUSD is emerging as a notable player in the stablecoin space. If adoption continues at the current pace, MetaMask could soon challenge established issuers by leveraging its massive user base and cross-chain reach.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.