Gaming Firm Expands Blockchain Strategy with Equity Tokenization

SharpLink Gaming has announced plans to tokenize its Nasdaq-listed SBET stock on the Ethereum blockchain, partnering with Superstate to execute the move through its Open Bell tokenization platform. The initiative positions SharpLink among a growing number of companies exploring tokenized equity trading in decentralized finance (DeFi).

A Strategic Partnership with Superstate

SharpLink’s co-CEO emphasized that “tokenizing SharpLink’s equity directly on Ethereum is far more than a technological achievement — it is a statement about where we believe the future of the global capital markets is headed.” By leveraging Superstate’s Open Bell platform, SharpLink joins other firms, including Forward Industries, in bringing traditional equities onto blockchain networks.

The partnership aims to explore how tokenized shares could eventually trade on automated market makers (AMMs) and other DeFi protocols in a compliant framework. This would allow for direct, blockchain-based equity trading without relying on traditional intermediaries.

Second-Largest ETH Holder Among Public Firms

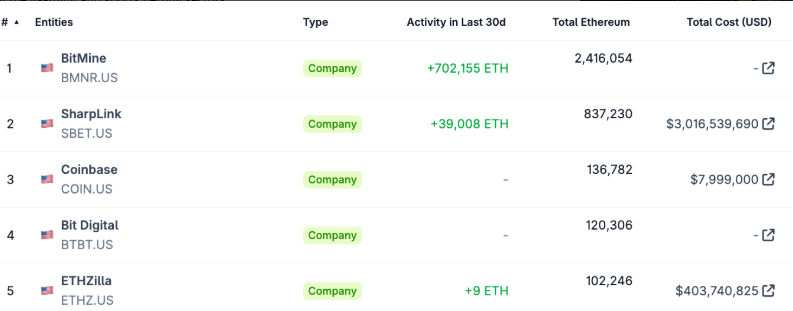

Founded in 2019, SharpLink operates as a performance-based marketing company serving the iGaming and sports betting sectors. In June 2025, it pivoted to establish a corporate Ethereum treasury, making it the second-largest public holder of ETH as of September 25.

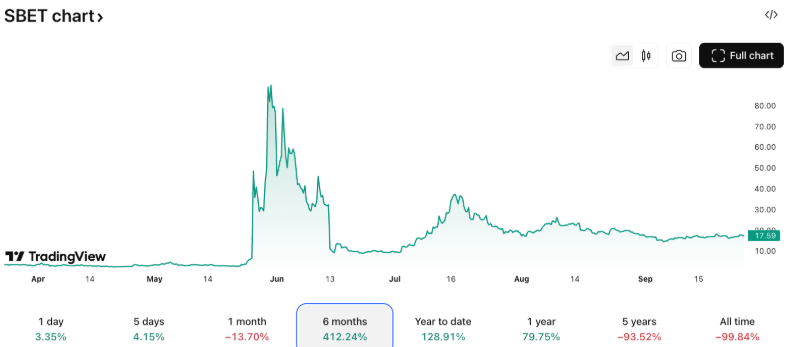

The company’s shares have experienced volatility tied to this strategy. Following its ETH treasury announcement in May, SBET stock surged more than 100% in just days, climbing from $40 to nearly $90 before retreating below $40 by mid-June.

Tokenization and Market Impact

The tokenization of SBET marks a significant step in blending traditional equities with blockchain infrastructure. Analysts note that while the move could unlock new liquidity pathways for investors, it also underscores the experimental stage of tokenized stock markets.

With its Ethereum-based equity tokenization, SharpLink is pushing boundaries in both blockchain adoption and capital market innovation. The success of the initiative will likely depend on regulatory clarity and investor appetite for trading tokenized equities on decentralized platforms.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.