Modular design and advanced risk controls mark the most significant update in Aave’s history

The decentralized finance (DeFi) market is preparing for a major shift as Aave readies its V4 protocol upgrade, scheduled for release in the final quarter of 2025. The update is expected to transform the way liquidity flows across lending markets, with new features designed to improve efficiency, transparency, and user protection.

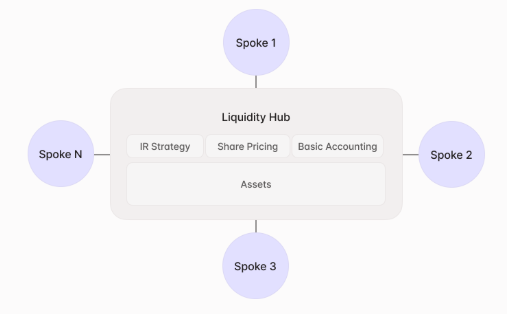

Aave V4 will replace the current monolithic framework with a “hub-and-spoke” design, where a central liquidity hub connects to multiple lending markets, or spokes. Each spoke can operate under unique risk parameters and lending rates, while still drawing from a shared liquidity pool.

“This design allows for more tailored markets without sacrificing liquidity depth, which has often been a challenge in DeFi platforms,” said one industry analyst.

Unified User Dashboard

The protocol will also introduce a streamlined interface that gives users a wallet-level overview of their positions across all markets. Borrowers and lenders will be able to route trades, track performance, and monitor risks in one unified view.

Smarter Liquidation and Risk Management

A major innovation is the health-targeted liquidation engine, which liquidates only the necessary portion of a loan to restore collateral ratios. This protects borrowers from losing entire positions while ensuring lenders recover funds.

“Dynamic risk settings mean users are less exposed to sudden protocol-wide changes, a common issue in earlier versions,” explained a DeFi researcher.

The new Position Manager will automate key functions such as withdrawals, repayments, and borrowings. A multi-call feature will also allow users to batch transactions into a single action, reducing gas fees and execution complexity.

The launch comes as DeFi total value locked (TVL) surpasses $156 billion, nearing levels last seen in late 2021. Aave itself has crossed $40 billion in TVL, reinforcing its dominance in decentralized lending.

With V4, Aave aims to provide greater flexibility, lower risk, and a more intuitive user experience — positioning itself as a leading platform in the next phase of DeFi growth.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.