Market Saturation and Debt Concerns Pressure Corporate Proxies

While Bitcoin, Ethereum, and other major cryptocurrencies have shown resilience, many public companies holding digital assets in their treasuries are significantly underperforming. Analysts warn that weak performance among these so-called “crypto treasury companies” could amplify risks in the next market downturn.

Corporate Proxies Lag Behind Bitcoin

Strategy, the largest Bitcoin treasury company, is down nearly 45% from its all-time high of $543 per share, despite Bitcoin gaining about 10% since its November peak above $99,000. BTC has since set new highs, surpassing $123,000 in August, but Strategy has failed to recover its previous levels.

Japan-based Metaplanet shares have fallen 78% from May’s high of $16 to around $3.55, even as Bitcoin is down only about 2% from its May high above $111,000.

Analysts at Standard Chartered pointed to market saturation as a key factor. “We see market saturation as the main driver of recent mNAV compression,” they wrote, referring to the contraction in the multiple on net asset value (mNAV), a valuation metric comparing enterprise value with underlying assets.

Altcoin Treasury Plays Hit Harder

The underperformance is even more severe among companies holding altcoins. SharpLink Gaming, an Ether treasury company, has dropped 87% since spiking to $124 in May, now trading at about $15.72 — despite ETH rallying 115% in the same period.

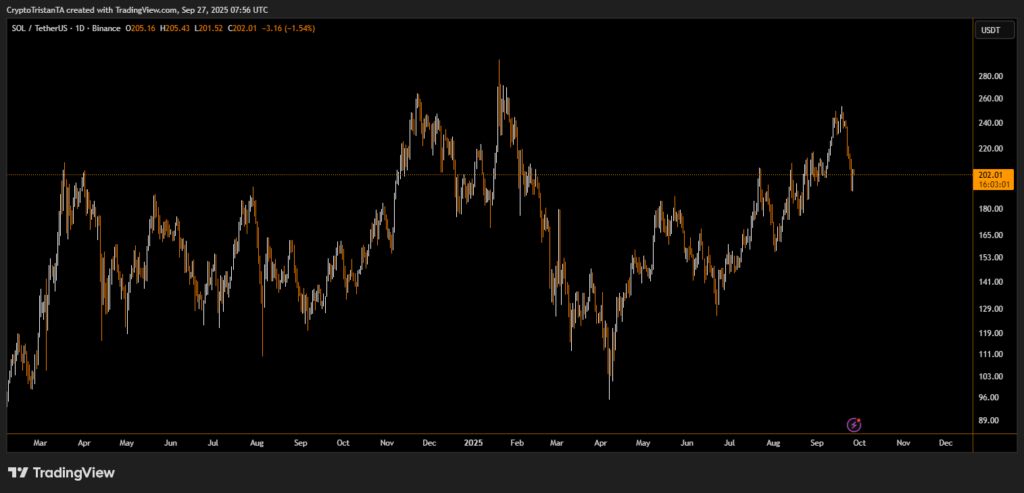

Helius Medical Technologies, a Solana treasury holder, has lost over 97% of its value in 2025, while Solana itself is down only 33% from its January high near $295.

Similarly, CEA Industries, which adopted a BNB treasury strategy, has fallen 77% since August, declining from over $34 to $7.75, even as BNB hit a record above $1,000 in September.

SOL is only down about 33% from its all-time high of about $295, which it reached in January amid the memecoin frenzy.

Investors initially expected these companies to outperform the underlying crypto assets. Instead, their steep declines have created fears of forced selling to cover debts, which could worsen future market corrections.

As Standard Chartered analysts highlight, the crowded corporate treasury model is losing momentum, raising doubts about whether such companies can deliver long-term value compared to simply holding the assets directly.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.