A new CoinGecko survey highlights a major shift in how retail investors are entering the crypto market. While Bitcoin (BTC) was once the undisputed entry point for newcomers, the data shows that it is now just one of many ways for retail users to onboard into the digital asset space.

Bitcoin’s Declining Role as a Gateway

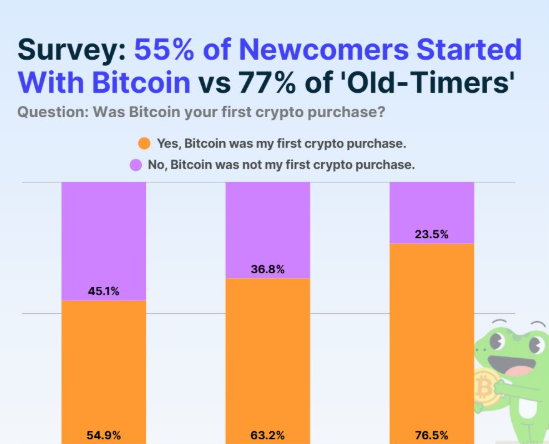

According to the survey of 2,549 crypto participants, only 55% of new crypto owners started with Bitcoin, while 10% of respondents have never bought BTC at all. This marks a notable decline from earlier years, when Bitcoin was widely seen as the primary first purchase for crypto investors.

CoinGecko research analyst Yuqian Lim noted that “Bitcoin has become less likely to be the onboarding mechanism over time, as other narratives and altcoin communities have emerged and gained traction.

The survey found that 37% of respondents first entered the market through altcoins, with many citing lower costs and stronger community appeal compared to Bitcoin.

- Hank Huang, CEO of Kronos Research, explained that new investors are often drawn to cheaper tokens, vibrant communities, and fast-moving narratives around ecosystems like Ethereum (ETH), Solana (SOL), and memecoins.

- This reflects a maturing crypto market, where diversification is a bigger driver of participation than a single “gateway asset.”

Perception of Bitcoin as “Too Expensive”

Another factor deterring some newcomers is Bitcoin’s high price, which recently surpassed $124,000 in August 2025.

- Tom Bruni of Stocktwits suggested that some latecomers believe they’ve “missed the boat” on Bitcoin and instead look for cheaper alternatives with higher short-term upside potential.

- He added that performance-driven investors often flock to altcoins during bull runs, but may eventually retreat to Bitcoin during market corrections for stability.

Bitcoin’s Enduring Importance

Despite the trend toward altcoin onboarding, experts emphasize that Bitcoin remains the anchor of the crypto ecosystem.

- Jonathon Miller of Kraken noted that as global uncertainty grows, many investors will “circle back” to Bitcoin because of its reputation as the soundest form of money.

- Qin En Looi of Onigiri Capital compared Bitcoin to gold in traditional finance, arguing that while its dominance may decline, it will never disappear as the benchmark asset for the crypto industry.

Market Outlook

The survey underscores the broadening of investor preferences as the industry matures. Bitcoin may no longer be the sole gateway, but its role as the market’s foundation remains intact. Meanwhile, altcoins, stablecoins, and tokenized assets are expanding crypto’s appeal to a wider audience.

In short, Bitcoin is evolving from the default entry point into a long-term cornerstone of diversified portfolios, while altcoins increasingly act as the first stop for retail newcomers.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.