Digital Asset Treasuries Seen as Long-Term Bridge Between TradFi and Crypto

The surge of corporate digital asset treasuries (DATs) has led some market watchers to warn of a potential bubble, but industry leaders suggest the fears are premature. Speaking at the Token2049 conference in Singapore, TON Strategy CEO Veronika Kapustina argued that while current indicators resemble a bubble, the medium- and long-term outlook remains strong.

Early Excitement, Not a Collapse

Kapustina acknowledged that “obviously, it looks like it’s a bubble,” pointing to the rush of speculative capital. However, she emphasized that this phase is part of the natural cycle for emerging financial instruments.

“There’s a lot of excitement for a surge in something new. Then it peters out, and a bit of consolidation, and then the real medium- to long-term capital comes in,” she explained.

She described digital asset treasuries as a bridge between traditional finance and crypto, noting that while some projects may struggle, consolidation will strengthen the sector rather than trigger a crash.

Beyond Bitcoin: Expanding the Model

The treasury model gained global attention when Michael Saylor’s firm pioneered the approach with Bitcoin, and this year has proven it can extend across multiple assets. Successful launches have included Ether, Solana, and Toncoin, with Toncoin supported directly through Kapustina’s firm.

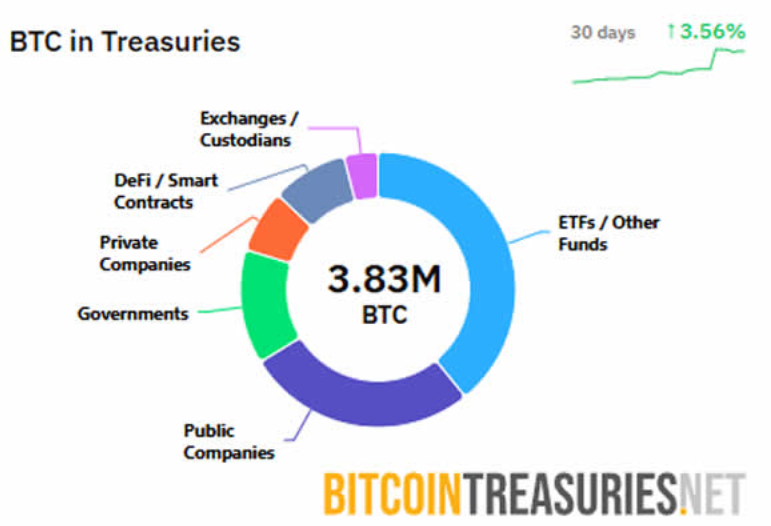

More than 1.3 million BTC, worth around $157.7 billion, are now held in corporate treasuries—representing 6.6% of the circulating supply. On the Ethereum side, 5.5 million ETH valued at nearly $24 billion have been locked into treasuries, amounting to 4.5% of the total supply.

The Future of DATs

Kapustina suggested several evolution paths for the sector, including infrastructure provision, banking services, mergers and acquisitions, and cross-chain technology bridges. Over time, she argued, investors will recognize the utility of DATs in both securing blockchain networks and serving as a financing tool.

While the rapid rise of DATs has drawn comparisons to past financial bubbles, industry leaders see the trend as an early-stage transformation rather than a speculative mania. As consolidation takes place, longer-term institutional capital is expected to flow in, reshaping how both traditional finance and crypto interact.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.