Largest order in over three years signals renewed U.S. interest in mining infrastructure

Canaan Inc. shares surged more than 26% on Thursday after the crypto mining hardware manufacturer confirmed a 50,000-unit order for its latest-generation “Avalon A15 Pro” Bitcoin mining rigs. The deal, described as the company’s biggest in more than three years, highlights growing U.S. demand for high-efficiency institutional-grade mining infrastructure.

U.S. appetite for Bitcoin mining grows

While the buyer’s identity has not been disclosed, Canaan’s CEO Nangeng Zhang said the agreement reflected both companies’ “confidence in the long-term growth of the Bitcoin mining industry” and the need for next-generation infrastructure.

The United States remains the world’s largest mining hub, accounting for around 36% of the global Bitcoin hashrate, according to Hashrate Index. This underscores the country’s dominant role in securing the blockchain despite rising energy costs and increasing competition.

Canaan stock performance

At the time of writing, Canaan’s shares traded at $1.31 on Nasdaq, marking a 26.4% single-day gain. The stock has climbed more than 50% in the last six months, although it is still down 40% year-to-date, according to market data.

Mining challenges intensify

Bitcoin mining difficulty continues to climb, reaching 150.84 trillion in early October 2025, a record high. This metric measures how hard it is to mine new blocks, meaning Bitcoin is more difficult to mine today than ever before.

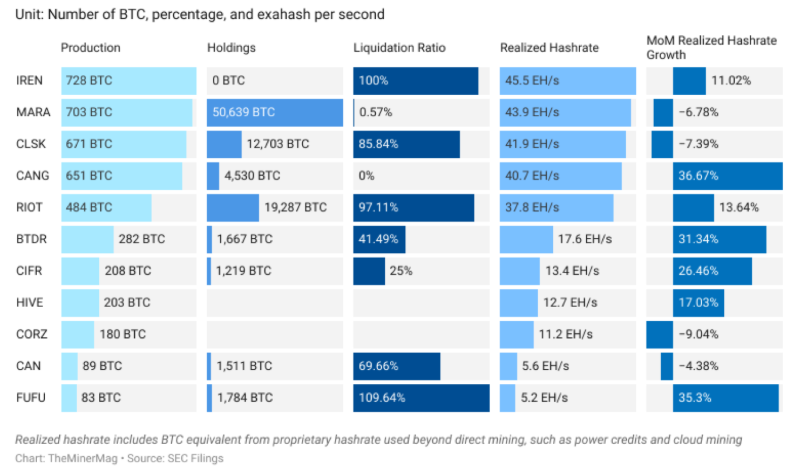

Rising difficulty has pushed smaller operators out of the market, while large institutional miners now dominate production. According to The Miner Mag, the top four public miners — MARA, IREN, Cango, and CleanSpark — controlled 19.07% of block rewards in July 2025.

Despite consolidation, solo miners still occasionally succeed. In July, two independent miners earned rewards of over $350,000 and $373,000 by solving blocks, demonstrating that opportunities remain even in a challenging landscape.

Industry opinions remain divided. Some executives, like Bit Digital’s Sam Tabar, argue that “the Bitcoin mining industry is going to be dead in two years” due to high costs and the next halving event. Others see continued investment in energy-efficient machines and scaling by institutional miners as proof of long-term resilience.

With its largest sale in years, Canaan is positioning itself at the heart of this evolving market — betting that Bitcoin mining remains a viable and growing sector in the U.S.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.