The Ethereum Foundation (EF) has announced the conversion of 1,000 Ether (ETH), worth approximately $4.5 million, into stablecoins. The move is aimed at funding research, ecosystem grants, and decentralized finance (DeFi) initiatives, reflecting the foundation’s broader treasury strategy.

The transaction was executed through CoW Swap, a decentralized trading protocol that aggregates liquidity across multiple exchanges. By using this method, the foundation avoided reliance on centralized intermediaries while ensuring competitive pricing and efficient execution.

The EF did not disclose which stablecoins it received in exchange. However, this is not the first conversion of its kind. In September, the foundation revealed plans to convert 10,000 ETH into stablecoins over several weeks. The latest move, however, appears to be separate from that initiative, given its smaller scale and execution method.

Balancing Treasury and Ecosystem Growth

According to its official Treasury Policy, the Ethereum Foundation seeks to balance two objectives:

- Generating returns above a benchmark rate

- Supporting Ethereum’s ecosystem development

Stablecoins are increasingly playing a central role in this strategy, offering predictable liquidity to support grants, operational expenses, and ecosystem funding.

Ecosystem Support and Grant Priorities

The conversion also comes as EF temporarily paused open grant submissions due to an influx of applications. Instead, the foundation plans to prioritize funding for the network’s most pressing needs, ensuring capital is directed toward areas that directly enhance Ethereum’s scalability, security, and adoption.

Earlier this year, the EF announced a leadership restructuring, appointing Hsiao-Wei Wang and Tomasz K. Stańczak as co-executive directors to improve governance and operational strategy.

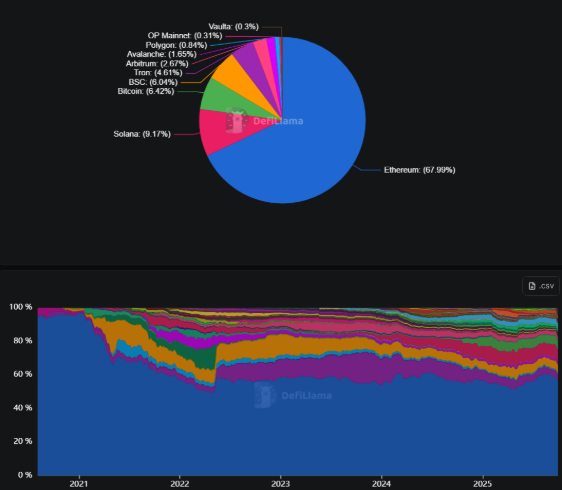

Despite rising competition from other blockchains, Ethereum continues to dominate DeFi. The network accounts for about 68% of total value locked (TVL) across DeFi platforms, according to DefiLlama. While this is a decline from its 2021 peak, Ethereum remains the leading platform for decentralized finance.

Ethereum co-founder Vitalik Buterin recently emphasized the importance of “low-risk” DeFi applications, such as payments, savings, synthetic assets, and fully collateralized lending. He argued that these tools could provide sustainable long-term revenue for Ethereum, much like Google Search underpins Google’s business model.

The Ethereum Foundation’s decision to convert 1,000 ETH into stablecoins highlights its long-term focus on stability, ecosystem funding, and sustainable growth. By strengthening its treasury position, EF ensures it can continue to fund innovation, support developers, and maintain Ethereum’s leadership in the DeFi space.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.