Investors adopt cautious strategies as inflated valuations and weak usage data redefine funding in 2025

The era of “hype-driven” crypto investing appears to be fading. According to market executives, venture capitalists are becoming far more selective, focusing on sustainability and measurable adoption rather than trendy narratives.

Sylvia To, director at Bullish Capital Management, explained that VCs are now approaching the market with heightened caution, especially after years of speculative investment cycles. “Before, you could throw a check at any new layer-1 and call it the next Ethereum killer,” she said during an industry event in Singapore. “Now the question every investor asks is simple — who is actually using it?”

To noted that the fragmented landscape of new blockchains and protocols has forced investors to evaluate on-chain activity before committing capital. “You really have to think about whether these networks have sufficient transactions and user volume to justify the funds being raised,” she added.

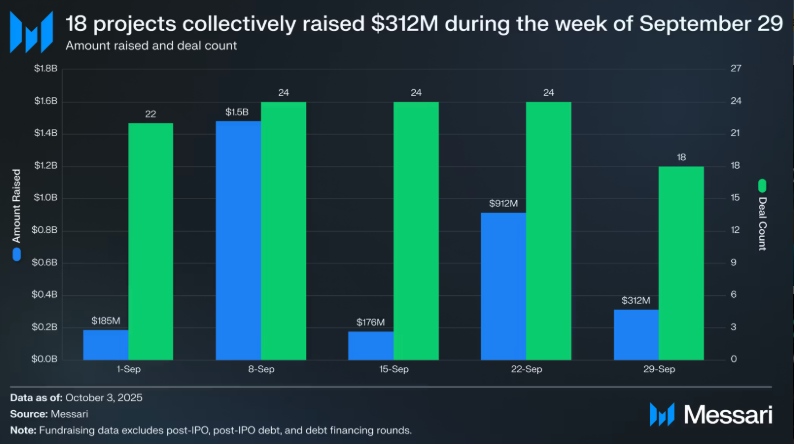

Data from Messari shows that 18 crypto startups collectively raised $312 million in the final week of September 2025 — a slowdown compared to the explosive fundraising phases of earlier years. To described this year as “a slow one,” citing inflated valuations and unrealistic revenue projections as key deterrents.

Market correction and maturing capital discipline

Eva Oberholzer, chief investment officer at Ajna Capital, echoed the sentiment, emphasizing that crypto venture capital is entering a phase of maturity. “It’s no longer about chasing momentum,” she said. “Investors now prefer predictable revenue models, institutional-grade products, and irreversible adoption trends.”

Galaxy Research’s data supports this shift: crypto startups raised $1.97 billion across 378 deals in Q2 2025, marking a 59% drop in total funding compared to the previous quarter.

Industry analysts suggest this recalibration could prove healthy long-term, weeding out speculative projects while encouraging more utility-driven innovation. As one executive summarized, “Capital is still here — it’s just finally growing up.”

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.