ETH momentum strengthens amid rising investor confidence and macro optimism

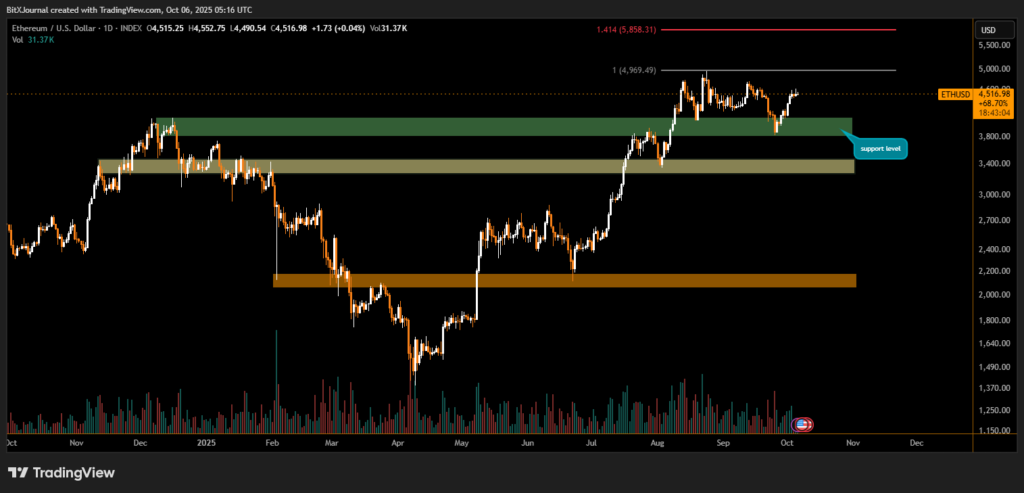

Ethereum (ETH) has surged past the $4,500 mark, signaling renewed bullish momentum as traders anticipate a potential test of the $5,000 resistance zone. After several weeks of consolidation, ETH has regained upward traction, supported by a strong base between $3,800 and $3,400, which continues to act as a crucial demand area for buyers.

Market data shows ETH/USD holding steady above the breakout level with volume trending higher — a sign that institutional participation and retail interest remain robust. Analysts say the recent strength reflects broader optimism in both crypto and equity markets, driven by improved liquidity conditions and rising risk appetite.

“Ethereum’s structure has turned decisively bullish above $4,500. As long as price stays above $3,800, the market may be gearing for a new cycle high around $4,970,” said BITX market strategist.

The chart also indicates that Ethereum’s next resistance lies near $4,970, corresponding to a Fibonacci extension level, while the next target beyond that sits around $5,850, representing the 1.414 extension. If buyers maintain control, this could mark the strongest performance for ETH since early 2022.

Meanwhile, Bitcoin’s dominance hovering near 59% suggests that capital is gradually rotating back into altcoins, with Ethereum expected to be the primary beneficiary. Other major tokens such as Solana (SOL) and Avalanche (AVAX) have also shown upward movement in response to Ethereum’s trend, hinting at a potential altcoin revival in the weeks ahead.

“As Ethereum continues to outperform, we’re seeing a shift in trader sentiment from defensive positioning to aggressive accumulation,” According to BITX analysts.

Ethereum’s sustained stability above $4,500 could be a key indicator of broader market confidence — setting the stage for a potential retest of all-time highs if momentum continues.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.