The memecoin market continues to struggle amid heightened volatility, with PEPE slipping another 5% in the past 24 hours as broader crypto sentiment remains fragile following last week’s $20 billion market-wide liquidation. The token’s price dropped to $0.0000074, consolidating just above a key support zone near $0.0000070, according to technical data.

Analysts note that the recent dip in PEPE is part of a wider correction trend affecting speculative digital assets, particularly after whale addresses began offloading large positions during the October 11 market crash. Trading volume surged sharply, signaling renewed short-term speculative activity and potential instability across the memecoin segment.

“We’re witnessing a period of capital rotation, where liquidity is leaving high-risk tokens like PEPE and returning to blue-chip assets such as Bitcoin and Ethereum,” said BITX market strategist. “Until confidence returns, memecoins may continue facing downward pressure.”

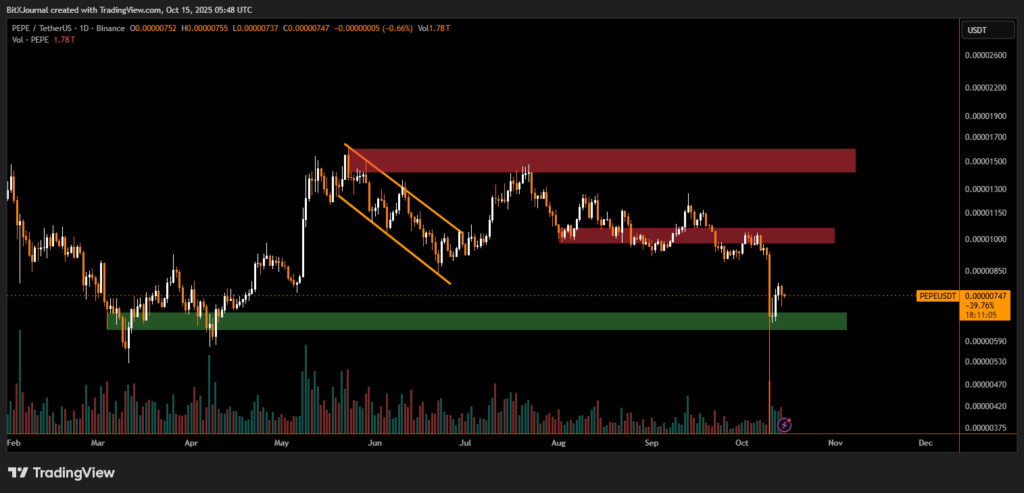

The daily chart reveals that PEPE has failed to sustain a breakout from the mid-range consolidation, retreating from resistance near $0.0000095–$0.0000100. The asset has repeatedly tested its demand zone between $0.0000068 and $0.0000075, an area that has historically attracted strong buyer interest.

However, BITX analysts caution that failure to hold above this level could trigger further declines toward $0.0000059, where the next major support lies. The recent spike in sell-side volume also suggests that short-term momentum remains bearish, even as long-term holders show signs of accumulation.

“Volatility is normal in the memecoin space, but the rapid rise in exchange inflows from whale wallets is a red flag for traders,” According to BITX analyst.

The pullback in PEPE coincides with a broader slowdown across the altcoin sector, following Bitcoin’s brief rally to its October 6 all-time high. Meanwhile, gold prices reached record levels, reflecting the market’s shift toward defensive assets amid ongoing financial uncertainty.

If PEPE can maintain support above the $0.0000070 range, a technical rebound remains possible—but sustained recovery will depend on improved liquidity and reduced selling pressure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.