Profit-Taking Intensifies Despite Typically Bullish Season

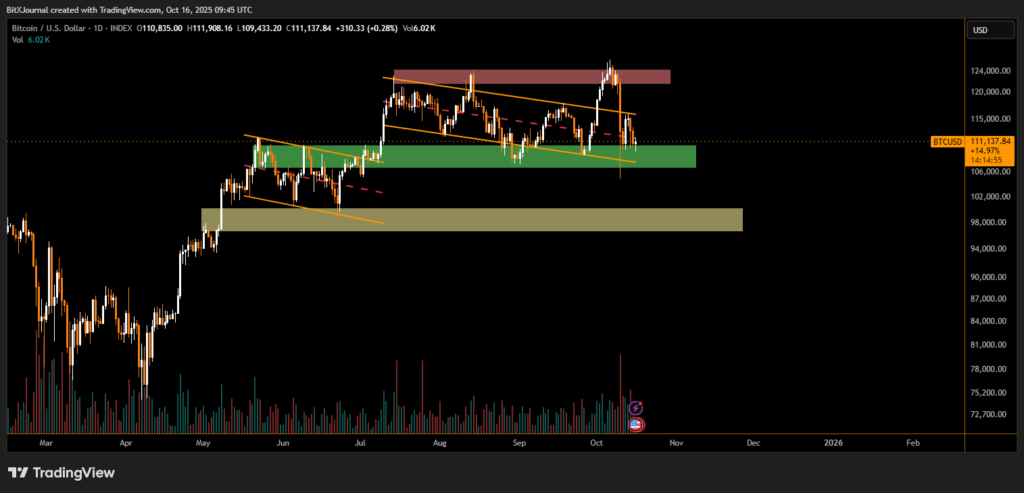

Bitcoin (BTC) is facing renewed selling pressure, even as the market enters what is usually a seasonally bullish phase. The world’s largest cryptocurrency continues to hover around $110,000, struggling to regain momentum amid heavy distribution from long-term holders (LTHs) and large whale investors.

According to on-chain data from Glassnode, long-term holders — defined as investors who have held Bitcoin for 155 days or more — have sold over 300,000 BTC since June, with 100,000 BTC offloaded in just the past few days. Despite collectively holding around 14.5 million BTC, this group has been steadily reducing exposure, signaling a broader wave of profit-taking.

“Given that nearly all LTHs are currently in profit, this trend reflects investors locking in gains after months of appreciation,” Glassnode analysts noted.

Whales Lead the Distribution Cycle

The data shows that whales holding more than 10,000 BTC are the primary distributors in the current market phase. Glassnode’s accumulation trend score reveals that these large entities have been consistent net sellers since August, while smaller investors — holding fewer than 1,000 BTC — continue to accumulate.

Entities holding between 1,000 and 10,000 BTC remain neutral, with an accumulation score of 0.5, suggesting indecision amid volatile market conditions.

“Whale selling pressure has historically marked consolidation phases,” said Lena Zhou, a market strategist at BlockAlpha Research. “This cycle’s selling may reflect a rotation of capital rather than a total loss of confidence in Bitcoin’s long-term narrative.”

The Four-Year Cycle Theory Under Scrutiny

Historically, Q4 has been a bullish period for Bitcoin, often driven by post-halving supply shocks and renewed investor optimism. However, analysts suggest that the current cycle may be breaking from tradition.

Eighteen months after the 2024 halving event, Bitcoin’s performance has lagged previous cycles, prompting some investors to question the validity of the four-year cycle theory. This uncertainty may be contributing to the accelerated selling activity among large holders.

“We’re seeing fatigue in the traditional cycle narrative,” said Ethan Park, senior analyst at ChainMetrics. “If macro or regulatory catalysts don’t emerge soon, Bitcoin could remain range-bound or face a deeper correction before the next leg up.”

While retail investors continue to accumulate BTC, the ongoing distribution from long-term holders and whales suggests that profit-taking may dominate in the near term. Unless a new catalyst reignites market optimism — such as ETF inflows, macro easing, or institutional demand — Bitcoin could remain under downward pressure despite its historically bullish fourth quarter.

For now, the market appears to be shifting from euphoria to equilibrium — testing whether Bitcoin’s long-term conviction can withstand another wave of profit-taking.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.