BTC drops to $105K while ETH slips below $3,800 amid rising sell pressure

The crypto market saw renewed volatility on Thursday as Bitcoin (BTC) fell toward $105,000, and Ethereum (ETH) dipped under the $3,800 support level, signaling a potential short-term correction after months of bullish momentum.

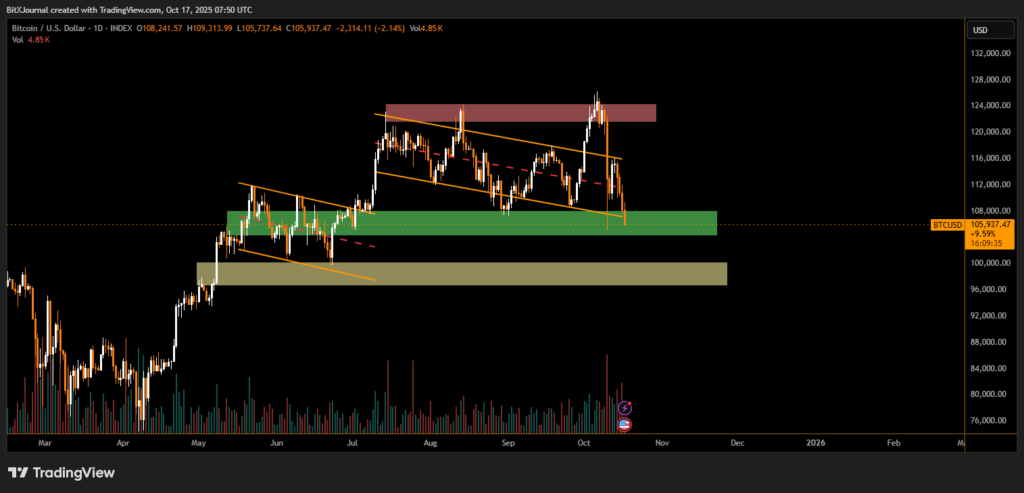

Bitcoin’s latest decline brings it closer to the lower boundary of its descending parallel channel, a structure that has defined its movement since early August. The asset, which briefly tested resistance near $120,000, is now retesting key demand around $104,000–$106,000 — an area that previously acted as the launchpad for July’s rally.

“The correction looks technical, not fundamental,” According to BITX analyst. “Bitcoin remains in a higher-timeframe uptrend, but near-term weakness was inevitable after the rapid run-up above $120K.”

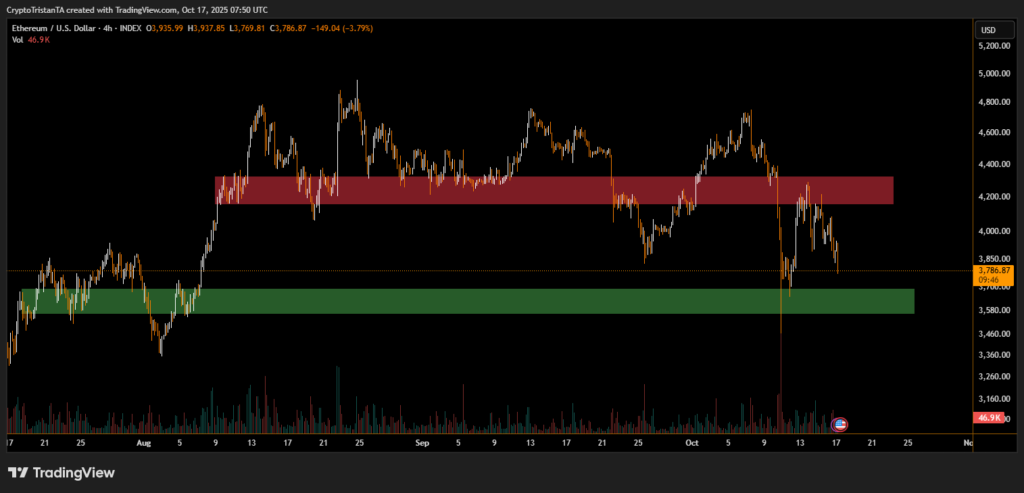

Ethereum, meanwhile, mirrored Bitcoin’s weakness. The second-largest cryptocurrency fell below $3,800, slipping from the upper supply zone around $4,200–$4,400. Analysts point to the strong support base between $3,550 and $3,700, which has historically absorbed heavy selling pressure.

“ETH is holding above major demand, but if that floor cracks, a deeper retracement toward $3,500 isn’t off the table,” explained BITX analyst. “However, institutional inflows into Ether ETFs continue to build, suggesting longer-term demand remains intact.”

The broader market pullback comes after weeks of overheated momentum and liquidations across leveraged positions. Trading volume has also spiked sharply, suggesting that short-term traders are taking profits ahead of the next leg of the cycle.

Despite the decline, most experts remain optimistic. “Corrections like these are part of every macro uptrend,” According to BITX . “The structure still supports a potential recovery as long as BTC stays above $100K and ETH holds $3,500.”

With key supports now being tested, all eyes are on whether buyers can reclaim control in the coming sessions. A rebound from these levels could mark the start of a new accumulation phase heading into the final quarter of 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.