The firm’s latest Bitcoin acquisition adds 168 BTC as it continues an aggressive multi-year accumulation plan.

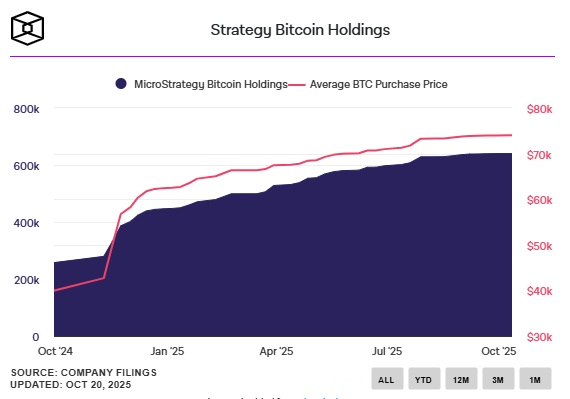

Bitcoin holding company Strategy has expanded its treasury again, purchasing an additional 168 BTC for approximately $18.8 million between October 13 and October 19, according to a new SEC filing. The acquisition was made at an average price of $112,051 per bitcoin, pushing the firm’s total holdings to 640,418 BTC — now valued at roughly $71.1 billion.

“The most important orange dot is always the next,” said Michael Saylor, Strategy’s executive chairman, hinting at the company’s ongoing accumulation approach.

The company’s Bitcoin stash now represents more than 3% of Bitcoin’s total 21 million supply, purchased at an average cost of $74,010 per coin, implying unrealized gains of over $23 billion.

Strategy funded its latest purchase through proceeds from the sale of its perpetual preferred stock programs, including STRK, STRF, STRD, and STRC, which collectively form part of its ambitious “42/42” capital plan. The initiative aims to raise $84 billion in equity and convertible notes by 2027 — doubling the size of the firm’s earlier strategy.

“Our capital structure is built to endure volatility,” Saylor explained in an earlier interview, adding that the firm can withstand a 90% decline in Bitcoin’s price for several years due to its balanced mix of equity, convertible debt, and preferred instruments.

According to Bitcoin Treasuries data, 190 public companies now hold Bitcoin on their balance sheets. Among the top institutional holders are Marathon Digital (53,250 BTC), Tether-backed Twenty One (43,514 BTC), and Metaplanet (30,823 BTC).

Despite the growing adoption, Strategy’s stock has fallen 36% since summer peaks, reflecting broader market caution amid renewed U.S.–China trade tensions. Still, shares were up 3.6% in pre-market trading on Monday, signaling investor confidence in the company’s long-term Bitcoin thesis.

Strategy’s expanding Bitcoin treasury underscores a sustained corporate pivot toward digital assets as balance sheet reserves — a trend accelerating despite short-term market volatility.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.