Analyst sees renewed growth potential with major U.S. orders, rising self-mining footprint, and gas-to-compute expansion

Canaan Inc. (NASDAQ: CAN), one of the leading global manufacturers of Bitcoin mining equipment, is showing signs of a strong rebound. According to a new research note from Benchmark, the company’s “accelerating turnaround story” is driven by growing demand for its Avalon A15 mining rigs, an expanding self-mining operation, and new strategic initiatives linking energy and computing infrastructure.

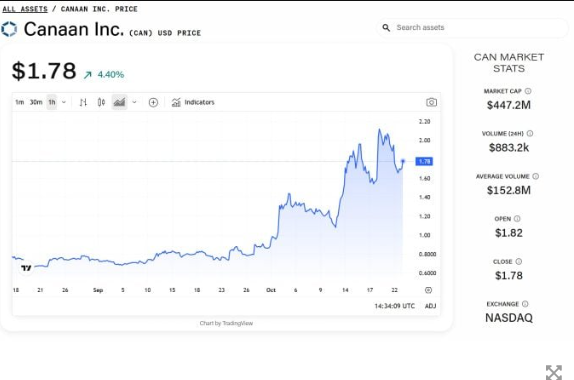

Benchmark analyst Mark Palmer reaffirmed a “Buy” rating on the stock and raised his price target to $4, more than double Canaan’s current share price of around $1.80. The move follows Canaan’s recent compliance with Nasdaq’s $1 minimum bid rule, which removed delisting risks that had long weighed on investor sentiment.

Avalon A15 orders lead growth momentum

Canaan recently secured a 50,000-unit order for its Avalon A15 series from a U.S.-based customer — the company’s largest single sale since 2022. Analysts view the surge in demand as evidence of renewed institutional interest in Bitcoin mining hardware ahead of the next halving cycle.

“With Avalon shipments accelerating and regulatory concerns now behind it, Canaan appears to be entering a phase of operational and financial stability,” Palmer wrote.

The firm also highlighted that Canaan’s treasury now holds 1,582 BTC and 2,830 ETH, worth approximately $184 million at current market prices. This positions the company with one of the strongest balance sheets among publicly traded mining firms.

Gas-to-compute pilot targets AI integration

In a move that could broaden its market reach, Canaan launched a gas-to-compute pilot project in Alberta, Canada, in partnership with Aurora AZ Energy. The initiative will convert stranded natural gas into clean electricity to power both Bitcoin mining and AI workloads.

“This hybrid energy model could position Canaan at the intersection of crypto and artificial intelligence infrastructure,” said an industry analyst familiar with the project.

With hardware sales rising, balance sheet strength improving, and new energy initiatives emerging, Canaan’s strategic turnaround is gaining investor confidence, signaling a potential return to growth in 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.