After a record-breaking rally, gold finds stability near the $4,000 mark, with analysts eyeing a potential rebound amid global uncertainty.

Gold’s recent surge has paused as the precious metal retraces from its all-time high near $4,516, stabilizing around the key $4,000 support zone. The pullback comes after a multi-week rally fueled by rising geopolitical tensions, inflation concerns, and continued demand for safe-haven assets. Market participants now watch closely to see whether gold can hold its psychological and technical floor or if further downside correction is ahead.

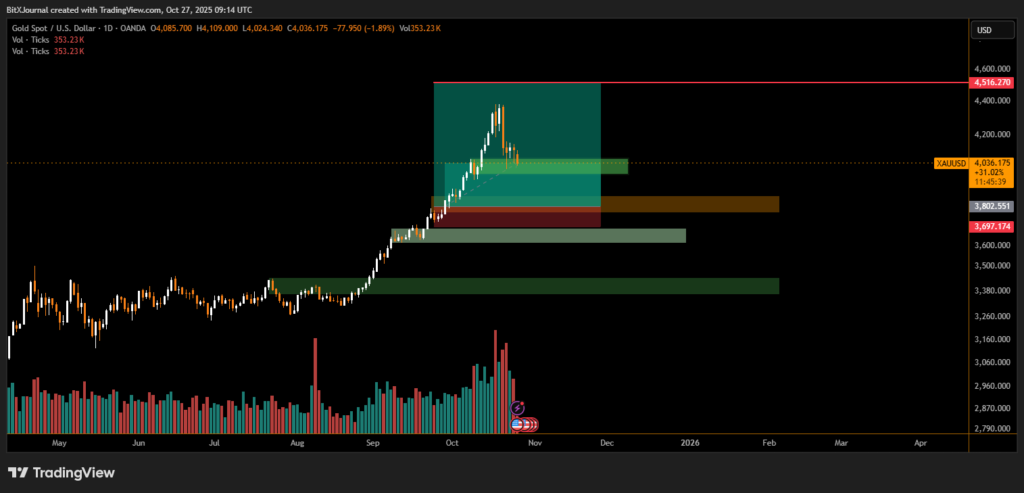

At press time, spot gold (XAU/USD) trades near $4,038, marking a 1.83% daily decline as traders take profits following a steep run-up in October. The chart indicates a clear retracement into a consolidation area between $3,950 and $4,050, aligning with previous breakout levels seen earlier this quarter.

Technical indicators suggest that momentum has cooled, but the broader structure remains bullish. A sustained close above $4,000 could reinforce this area as a foundational support, potentially setting up for another leg higher toward $4,300–$4,500 resistance. Conversely, a decisive drop below $3,800 could trigger a deeper correction toward the $3,700 region, which has acted as a strong historical demand zone.

“Gold’s retracement is healthy in context — we’ve seen significant overextension in recent weeks,” According to BITX commodities strategist. “The $4,000 level is now a critical line in the sand. If buyers defend it, we could see renewed momentum in November.”

BITX market analyst pointed out that volume spikes during the pullback indicate institutional repositioning rather than outright liquidation. “Smart money tends to accumulate near strong support levels, and current flows suggest that the bullish narrative isn’t over yet,” the analyst noted.

As gold tests the $4,000 threshold, traders remain cautiously optimistic. The metal’s ability to hold this level will determine whether the next move is a consolidation phase or a continuation toward new highs. Given the global macro backdrop — including rising inflationary pressures and central bank demand — analysts maintain that gold’s long-term outlook remains firmly constructive, even as short-term volatility persists.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.