Ottawa aims to include new rules for fiat-pegged digital assets in the November 4 budget as global competition heats up

Canada Moves Toward a Stablecoin Rulebook

Canada is fast-tracking the creation of a comprehensive stablecoin regulatory framework, with details expected to be unveiled in the federal budget update on November 4, according to reports from Bloomberg citing government sources.

The move underscores Ottawa’s growing urgency to establish clear rules for fiat-pegged cryptocurrencies, amid fears that delayed regulation could push capital and innovation toward U.S.-dollar-backed stablecoins and foreign markets.

Policy Focus: Classification and Capital Concerns

Officials from the Department of Finance Canada and several regulatory agencies have reportedly held intensive consultations in recent weeks with both industry stakeholders and policymakers. The discussions center on how to classify stablecoins — particularly whether they should fall under securities or derivatives laws — and how to prevent capital outflows from Canada’s financial system.

“Without domestic clarity, Canadian investors and institutions risk shifting to foreign stablecoin ecosystems,” warned John Ruffolo, co-chair of the Council of Canadian Innovators. He cautioned that prolonged uncertainty could erode demand for Canadian bonds, increase borrowing costs, and weaken the Bank of Canada’s control over liquidity.

Aligning With International Moves

Canada’s regulatory push mirrors broader global policy momentum around stablecoins. In the United States, the GENIUS Act, signed into law in July, formally categorized compliant stablecoins as payment instruments, though critics have argued it remains too lenient on crypto banks. Meanwhile, Europe’s MiCA framework already governs stablecoin issuers under strict standards, and Asia’s financial hubs — including Japan and Hong Kong — are accelerating their own rulemaking efforts.

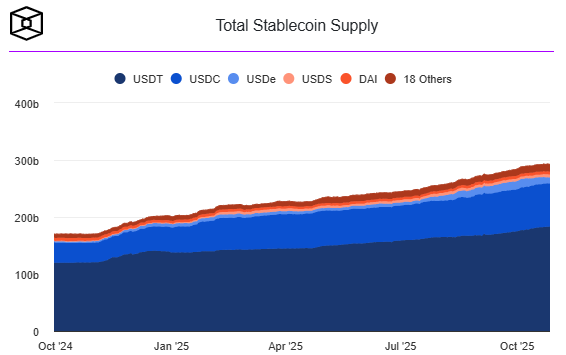

This synchronized global activity comes as the stablecoin market nears $300 billion in total supply, dominated by U.S.-dollar-pegged tokens from Tether (USDT) and Circle (USDC).

Analysts suggest Canada’s fast-tracked framework aims to ensure monetary sovereignty and competitive parity with foreign jurisdictions. Industry forecasts indicate the sector’s expansion could be dramatic — with Standard Chartered projecting up to $1 trillion flowing from emerging market deposits into U.S. stablecoins by 2028.

If included in next week’s federal budget, Canada’s stablecoin framework could mark a defining moment for its digital asset economy — establishing a foundation for regulated innovation while safeguarding domestic capital from migrating abroad.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.