Ethereum treasury firm boosts investor confidence by reducing outstanding shares amid market discount

ETHZilla, an Ethereum-focused digital asset treasury firm, has sold approximately $40 million worth of ETH as part of its ongoing $250 million stock repurchase plan, according to the company’s latest disclosure. The move highlights a growing trend among blockchain-based treasuries using digital assets to strengthen shareholder value.

The company’s stock, trading under the ticker ETHZ, surged more than 14.5% on Monday and continued climbing by another 9% during after-hours trading, reaching above $22.50 per share, according to market data. Despite the rally, shares remain well below their previous high of around $107, recorded when ETHZilla first announced its Ethereum treasury initiative.

ETHZilla’s approach mirrors that of SharpLink Gaming (SBET), another major ETH treasury, which recently authorized a $1.5 billion stock buyback plan to stabilize its valuation when shares trade below NAV.

Strategic buybacks amid valuation gap

The ETHZilla board of directors, which approved the $250 million repurchase program in August, has already bought back around 600,000 shares for nearly $12 million since October 24.

In a company statement, ETHZilla said it will continue selling portions of its ETH holdings to repurchase additional shares until the firm’s market price “more accurately reflects its net asset value (NAV).”

“We will continue repurchasing shares while ETHZ trades at a significant discount to NAV,” said Chairman McAndrew Rudisill, emphasizing that the plan is designed to reduce share supply and enhance shareholder returns.

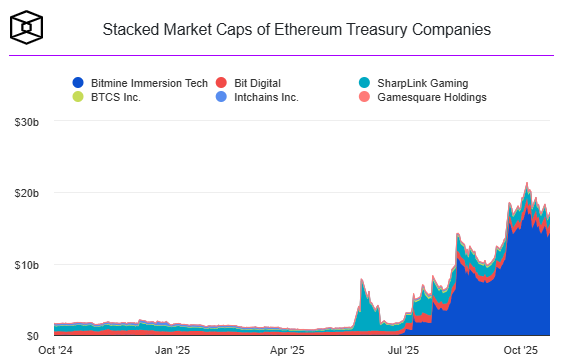

At present, ETHZilla reportedly holds around $400 million in Ethereum on its balance sheet, underscoring its position as one of the largest ETH treasuries in the market. The company’s focus on using crypto reserves to manage equity dynamics reflects a growing fusion between digital asset management and corporate finance.

In August, Peter Thiel’s Founders Fund acquired a 7.5% stake in ETHZilla, signaling rising institutional confidence in Ethereum-linked corporate models.

Analysts say ETHZilla’s strategy represents a new wave of digital treasuries using blockchain assets to drive traditional shareholder value, bridging decentralized finance with corporate capital management.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.