Market Holds Above $112K as Traders Watch Key Resistance Levels and Federal Reserve Outlook

Bitcoin (BTC) traded near $113,000 on Wednesday, consolidating after a brief rally toward $116,000 faded, as investors awaited the Federal Open Market Committee (FOMC) decision later today. Despite the short-term pullback, analysts say the move looks like a standard pre-FOMC dip, not a breakdown, and that clearing $120,000 could pave the way toward $143,000 in the coming weeks.

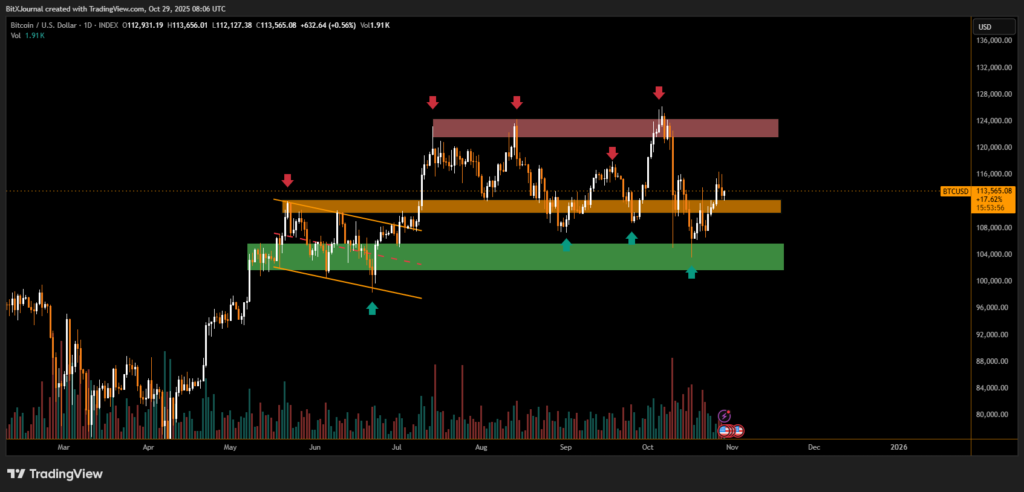

Bitcoin Price Range and Support Zones

The cryptocurrency found buying interest around $112,500, where traders stepped in after sellers capped gains near $116,000. On-chain data shows a strong support cluster between $111,000 and $112,000, suggesting that holding above this zone keeps the broader uptrend intact.

According to data analytics firm Glassnode, most recent buyers are concentrated around $111K, while stronger selling pressure sits near $117K — creating a tight trading range that defines current market sentiment. The firm’s cost-basis distribution model indicates that a breakout above $117K could trigger a broader rally, while a drop below $111K could invite more selling.

Analysts Eye $120K Breakout Toward $143K

Market strategist Ali Martinez believes that Bitcoin needs to reclaim $120,000 to unlock a potential advance toward $143,000, based on long-term pricing bands derived from on-chain data.

Meanwhile, trader Michaël van de Poppe called the recent correction a “routine dip” rather than a trend reversal. He expects $112K to act as a base, allowing the market to retest the $116K–$120K resistance zone before attempting higher levels.

“As long as $112K holds, the uptrend remains valid,” van de Poppe added, noting that such consolidations often precede renewed strength.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.