Crypto Market Pulls Back as Powell Warns That December Rate Cut Isn’t Guaranteed

Bitcoin (BTC) fell sharply on Wednesday, sliding to around $108,000, after Federal Reserve Chair Jerome Powell signaled that the U.S. central bank may delay its anticipated December rate cut, sparking renewed caution across risk assets. The decline came amid Powell’s warning that the Fed is “not yet confident” inflation is under control, even as he acknowledged signs of softening in the labor market.

The leading cryptocurrency dropped nearly 2.6% within 24 hours, extending a week-long pullback from the $116,000 level. Market participants viewed Powell’s statement as a sign that the Fed could keep monetary policy tighter for longer — a move that often dampens appetite for speculative assets like Bitcoin and equities.

Market Reaction and Technical Setup

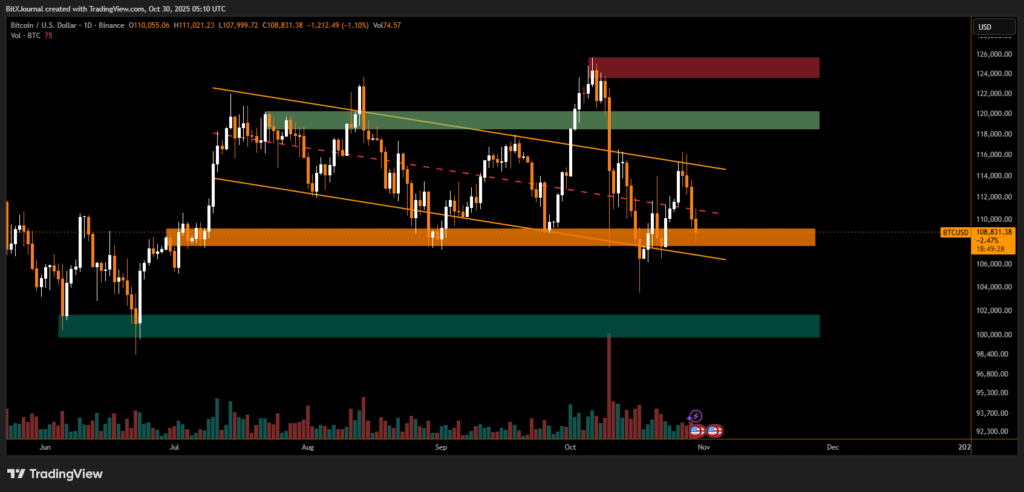

On the technical side, Bitcoin’s price action has re-entered a descending parallel channel, a structure that has guided its movement since mid-September. The latest rejection near $111,000 confirms continued weakness, with BTC now hovering just above the critical support zone between $107,800 and $109,000.

“This support area has been tested multiple times since August, and a decisive breakdown could trigger a deeper retracement toward $102,000,” said BitXJournal technical analyst.

Volume data shows heightened trading activity around this support, suggesting that bulls are attempting to defend this key level. However, momentum indicators remain negative, reflecting a cautious sentiment ahead of the Fed’s next policy communication.

Despite short-term weakness, many strategists believe the broader crypto outlook remains constructive. “While Powell’s tone was hawkish, the Fed’s acknowledgment of economic slowdown hints that easing could resume early next year,” noted a BitXJournal market strategist.

Bitcoin’s near-term trend will depend on whether buyers can hold the $108K level — a failure here may open the door to a retest of $102K, while a rebound could reignite momentum toward $114K.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.