LINK Rebounds from $17 Zone After Fed’s Hawkish Stance Triggers Short-Term Selloff

Chainlink (LINK) experienced sharp price swings on Wednesday, initially falling to around $17.47 before rebounding nearly 4% to close near $18.27, as traders reacted to heightened volatility following the Federal Reserve’s latest policy statement. The movement reflected broader crypto market turbulence after Fed Chair Jerome Powell suggested that a December rate cut was “not a foregone conclusion,” tempering investor risk appetite.

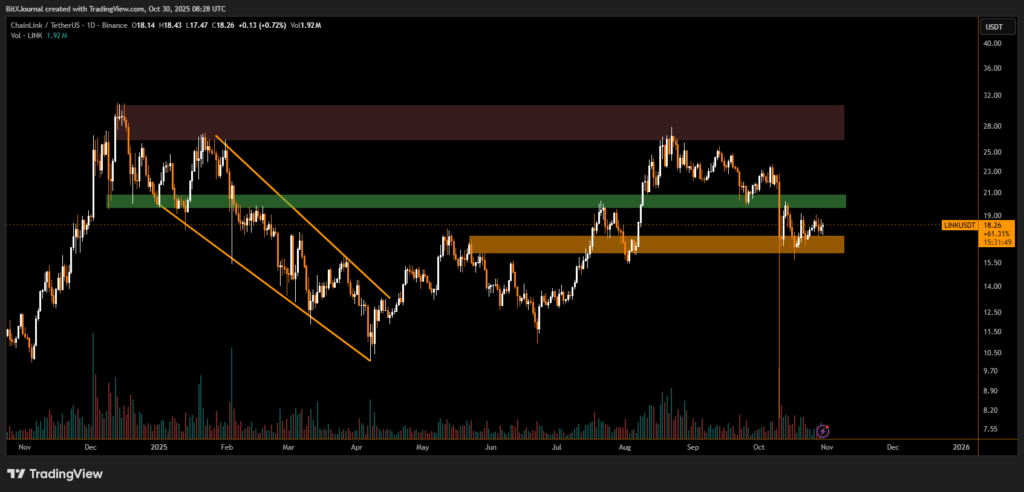

On the daily chart, LINK tested its $17–$17.50 support zone, a key area marked by prior accumulation in August, before bouncing back with strong buy-side volume. The recovery, though modest, underscored the resilience of buyers defending the lower band of the current consolidation range.

Technical Picture: Support Holding but Resistance Looms

Chart data shows LINK remains locked between a major resistance near $21–$22 and support around $16.80–$17.30. A descending channel breakout earlier this year had triggered a multi-month rally, but momentum has since cooled amid profit-taking and macro uncertainty.

“The $17 area has proven to be a reliable short-term floor,” said BitXJournal market analyst. “However, without a decisive close above $19.50, LINK could remain range-bound as traders weigh Fed policy and Bitcoin’s directional cues.”

Trading volume ticked up to 1.92 million tokens, signaling a moderate influx of activity around key price levels. Technical indicators, including RSI and MACD, show neutral bias, suggesting indecision among market participants ahead of upcoming U.S. economic data.

The FOMC’s decision to hold the federal funds rate at 4.00%, slightly below the previous 4.25%, added a layer of uncertainty across digital assets. While Chainlink’s fundamentals remain solid amid rising oracle adoption, short-term volatility is likely to persist until clearer Fed guidance emerges.

For now, maintaining support above $17 could keep LINK positioned for another test toward $19.50–$21, though a breakdown below that level might expose it to deeper retracement toward the $15 region.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.