HBAR price analysis suggests potential continuation after breakout

Hedera Hashgraph (HBAR) is showing renewed bullish strength following a breakout from a multi-week downtrend, with traders eyeing a possible move toward the $0.25 resistance zone if momentum sustains.

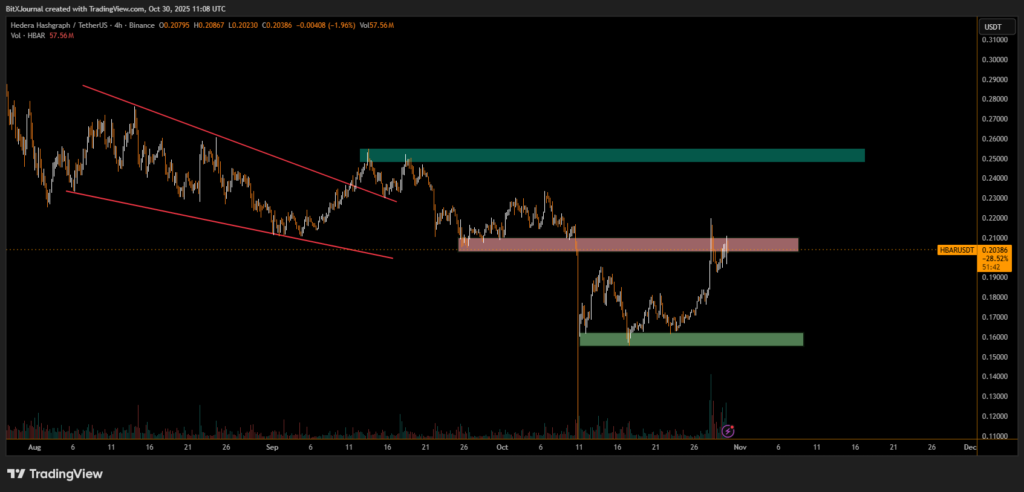

The HBAR/USDT pair is trading around $0.204, facing a crucial resistance zone between $0.205 and $0.21, according to recent 4-hour chart data. The asset broke out of a descending wedge pattern, a setup often interpreted by technical analysts as an early sign of trend reversal.

Over the past week, volume spikes have accompanied the upward move — a sign of growing participation and possible accumulation among market participants. If HBAR can maintain support above the $0.19–$0.195 area, analysts say the next upside target could extend toward the $0.25–$0.26 supply zone highlighted on the chart.

“A confirmed breakout above $0.21 with strong volume could signal the start of a mid-term bullish structure,” said BitXJournal technical analyst. “However, failure to hold above $0.19 may invite another retest of the lower support near $0.16.”

The green demand zone around $0.155–$0.165 remains a key defense area for buyers. Historically, this range has acted as a springboard for reversals, reflecting strong market interest at those price levels.

The Relative Strength Index (RSI) on shorter timeframes also shows improving momentum without signs of overextension — suggesting the rally may still have room to continue if broader market sentiment remains positive.

In summary, Hedera Hashgraph’s technical outlook is cautiously bullish, with traders watching for a clear break above $0.21 to confirm continuation toward the $0.25 resistance. A failure to maintain the current support, however, could shift focus back to the $0.16 accumulation zone, where buyers have previously stepped in to stabilize price action.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.