Analysts Warn of 30% Pullback Toward $260 Support Amid Market Uncertainty

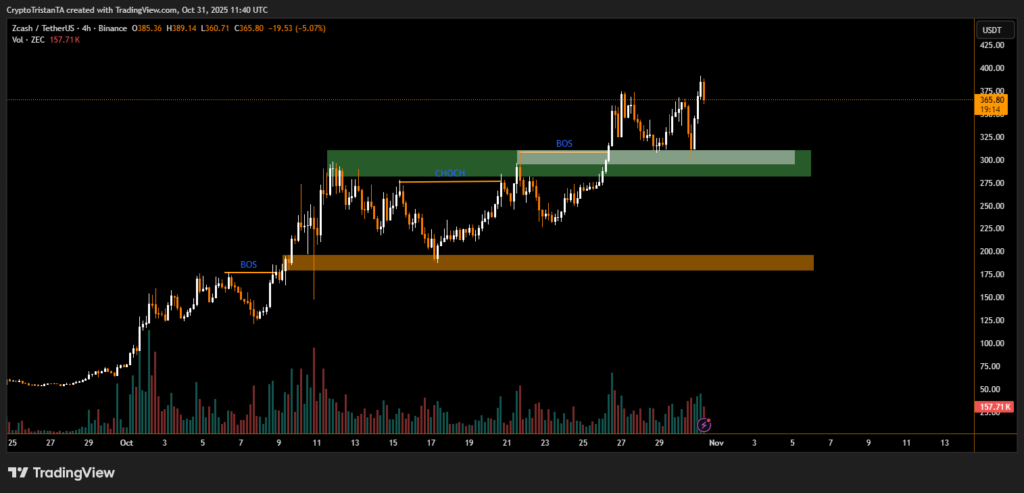

Zcash (ZEC) is showing signs of cooling off after a strong rally that lifted prices above $385, as traders begin to assess the sustainability of recent gains. The move, which followed a breakout above the $300 resistance zone, now faces a crucial test, with a rising wedge pattern on the 4-hour chart signaling the risk of a 30% downside toward the $260–$270 support area in November.

Currently, ZEC trades around $365, down about 5% in the past 24 hours, with trading volume near 157,000 tokens, reflecting a mild decline in short-term momentum. Despite the pullback, sentiment remains cautiously optimistic among some traders who view the recent breakout as part of a broader accumulation phase.

Technical Picture: Rising Wedge Meets Overhead Pressure

The chart highlights a clear rising wedge formation, a pattern often associated with weakening bullish momentum. Key demand zones lie between $290 and $310, while strong historical support sits near $180–$200, where previous breakouts occurred earlier this quarter.

“Zcash’s current rally looks technically overextended,” BitXJournal market strategist noted. “The rising wedge pattern suggests buyers may be losing strength, and a retracement toward the $260 region would be a healthy reset before any sustainable uptrend resumes.”

The recent break of structure (BOS) levels near $300 confirmed short-term bullish control, but failure to hold above $370–$380 could invite increased selling pressure as profit-taking accelerates.

If ZEC fails to sustain above $350, analysts expect a test of $270 by mid-November. However, holding above that support could set the stage for a potential rebound back to $400–$420 levels later in the month.

In the coming weeks, traders will be watching for a decisive break below $320 or a close above $390, both of which could define Zcash’s next major trend direction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.