Bitcoin once again tested the crucial $108,000 level on October 31, signaling renewed volatility and a potential turning point as traders eye breakout or breakdown scenarios ahead of November’s market catalysts.

Bitcoin Retests Key $108K Support Zone

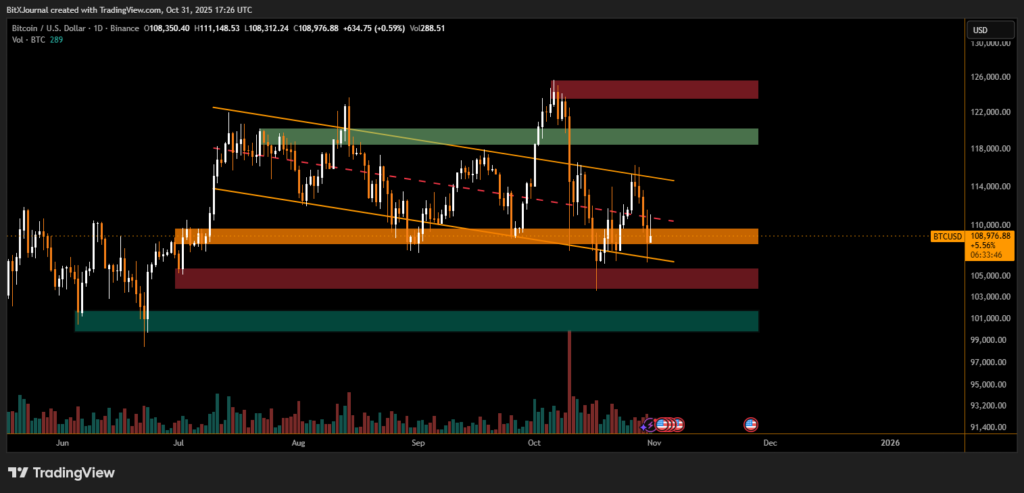

Bitcoin (BTC) bounced back toward the $108,000 mark, extending its recovery from early-week losses that saw it dip below key trendline support. The move highlights strong buyer interest near the lower boundary of its descending channel, visible on the daily chart.

Technical analysts observed that BTC has been trading within a broad downward channel since August, with each retest of the lower trendline prompting short-term rebounds. The $108K region now acts as both support and a psychological pivot, marking the area where bulls and bears continue to battle for dominance.

“The $108K level has become a battleground zone — losing it could open the door to $104K or even $101K, while a sustained close above $111K may flip market sentiment bullish again,” said BitXJournal market analyst familiar with institutional trading patterns.

Volume and Market Structure Support a Neutral Outlook

Trading volume remains steady, indicating accumulation pressure amid broader consolidation. Price action shows repeated rejections from the upper channel resistance near $115K, while buyers continue to defend the $107K–$108K demand area.

A move above $112K would likely trigger momentum buying, confirming a short-term reversal. Conversely, a drop below $106K could accelerate selling toward the $100K liquidity pool, where previous demand zones lie.

According to BitXJournal on-chain data specialists, “This phase represents a high-volatility compression zone — BTC’s next move will likely define November’s broader market direction.”

While Bitcoin’s current trajectory remains technically neutral, analysts note that macro conditions such as U.S. rate decisions and ETF inflows could determine the next breakout.

In summary, BTC’s repeated defense of the $108K level underscores strong buyer interest but also warns of waning momentum. Until a clear breakout from the descending structure occurs, traders are advised to remain cautious within this tightly bound range.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.