BCH Price Consolidates After Early Breakout, Traders Eye Key $553.50 Level

Bitcoin Cash (BCH) extended its rebound early Friday, breaking above the $550 resistance amid a noticeable volume spike around 1 a.m. UTC. The move marked a continuation of its short-term recovery, pushing the asset into a narrow range between $553 and $556 as traders awaited confirmation of follow-through momentum.

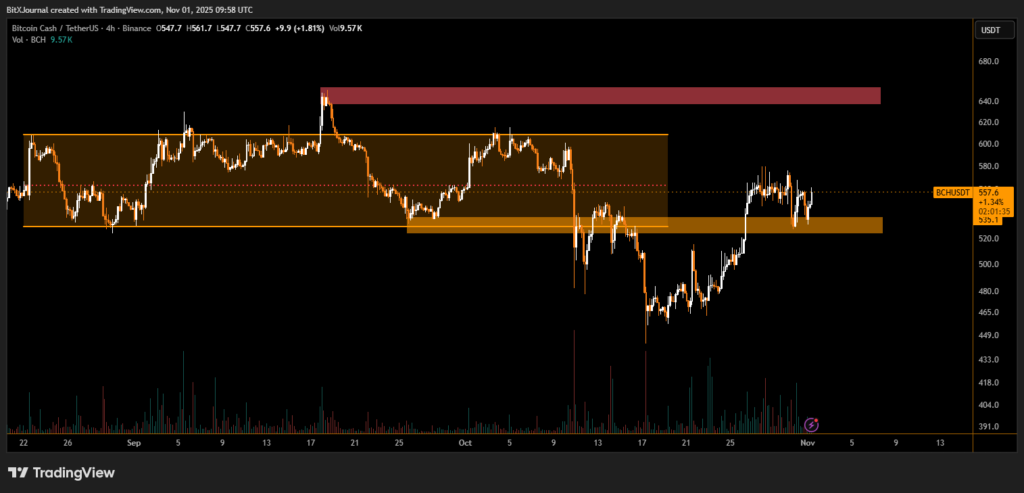

According to the 4-hour chart, BCH’s breakout from the lower consolidation band came after weeks of sideways trading between $470 and $540. The sharp uptick in trading activity coincided with a surge in volume, signaling renewed buying interest around the $520–$530 support area, which has now acted as a springboard for the latest leg higher.

“This move above $550 is technically significant,” said one BitXJournal market analyst. “The $553.50 zone is now acting as an immediate pivot level — holding above it could validate a short-term bullish structure.”

The upper resistance zone remains capped between $630 and $650, a region that rejected previous rallies in September. While the broader trend has yet to confirm a sustained reversal, the tightening price range and rising volume suggest building momentum.

BitXJournal analyst commented, “Bitcoin Cash is showing early signs of strength after defending $520 support. A clean break above $565 could open the door to $600, but failure to hold $553.50 might invite renewed selling pressure.”

At the time of writing, BCH trades near $557.9, up 1.86% on the session. Market sentiment remains cautious as participants monitor whether the recent breakout sustains above intraday support levels or fades back into the previous range.

If buyers manage to defend the $553.50 threshold through the next daily close, it could confirm a continuation pattern toward the mid-$580s. However, a breakdown below $550 would risk a retest of $525–$530, where the next demand zone is located.

For now, all eyes remain on how Bitcoin Cash behaves around this critical support band — a decisive move could shape its trajectory heading into November.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.