Stablecoins Dominate Daily Protocol Earnings Across Crypto Ecosystem

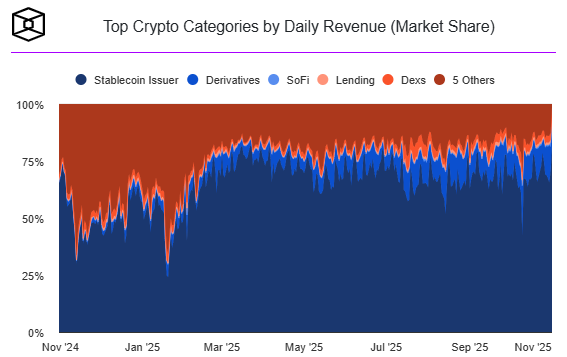

The stablecoin sector has quietly become the most profitable segment in the digital asset industry, now accounting for 60% to 75% of total daily protocol revenue. This dominance reflects how stablecoins have evolved from simple trading tools into core financial infrastructure powering decentralized finance (DeFi), lending markets, and exchanges worldwide.

According to recent market data, leading issuers such as Tether (USDT) and Circle (USDC) generate massive profits through yields earned on U.S. Treasuries and cash-equivalent reserves, while maintaining stable value for users. Tether, the largest player in the market, is projected to record $15 billion in profit this year, supported by a 99% profit margin — placing it among the most profitable financial institutions globally.

Regulatory Clarity and Competitive Innovation Drive Growth

A turning point came with the GENIUS Act, a U.S. law that formally classifies payment stablecoins as digital cash and prohibits issuers from paying direct yield to holders. This regulation has not slowed growth but instead spurred competition and innovation in value distribution.

“Stablecoins are transforming from transactional tools into yield-efficient financial instruments,” said a digital asset analyst from a leading blockchain research firm. “Even with restrictions on interest payouts, platforms are finding new ways to share value with users while staying compliant.”

For instance, Coinbase now rewards users who hold USDC on its platform with 3.85% annual returns, structured through the exchange rather than the issuer — an approach that respects regulatory guidelines while increasing adoption. Meanwhile, the rising USDe stablecoin is challenging incumbents by introducing a synthetic yield model, signaling a shift toward more dynamic structures in the market.

Stablecoins Cement Their Role in the Future of Digital Finance

With stablecoins now underpinning global crypto liquidity, their impact extends beyond DeFi into cross-border payments, remittances, and tokenized asset markets. Analysts predict that as competition intensifies, issuers will focus more on transparency, compliance, and innovative yield models to retain market share.

Stablecoins have become the backbone of the crypto economy — offering stability, profitability, and scalability that few other digital assets can match.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.