Support levels strengthen as traders eye potential breakout momentum

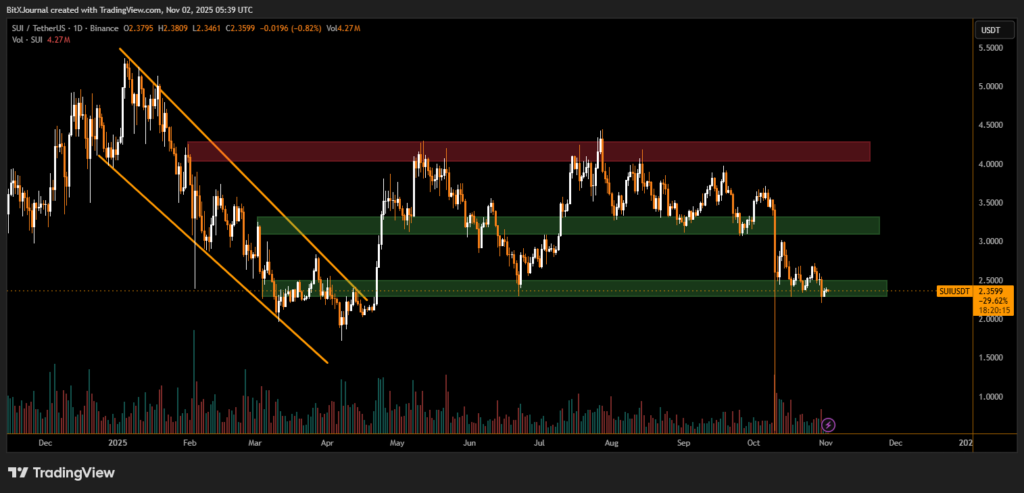

The Sui (SUI) token has recorded a strong 8% gain in the last 24 hours, signaling renewed interest among traders after a period of sideways movement. According to recent market data, SUI is currently trading near $2.35, showing signs of stabilization above a major support zone between $2.20 and $2.50. This range has acted as a crucial demand area multiple times throughout 2025.

Technical charts indicate that SUI recently bounced from a descending channel, which had been in place since early March. The breakout from that downtrend aligns with rising trading volumes, suggesting that buyers are regaining control. Analysts note that the next resistance zone lies between $3.00 and $3.50, an area that previously saw heavy selling pressure.

“If SUI can maintain support above $2.30 and push past the $2.80 mark, it could trigger a mid-term reversal,” said one of BitXJournal market strategist. “Volume confirmation and higher lows will be key signals of sustained bullish momentum.”

The long-term structure still shows notable volatility, but technical analysts are pointing to bullish divergences forming on daily charts, often a sign of trend exhaustion among sellers. Momentum indicators like the Relative Strength Index (RSI) have also begun turning upward from oversold territory, reinforcing the potential for a relief rally.

BitXJournal experts noted that institutional interest in Layer-1 blockchain projects remains strong despite broader market uncertainty. “Projects with solid ecosystems, such as Sui, are beginning to attract renewed liquidity as investors look for undervalued assets,” they said.

The overall sentiment for SUI appears cautiously optimistic, provided it continues to hold above its key base. A decisive break below $2.20, however, could invalidate the short-term bullish setup and push prices back toward the year’s lower ranges.

As technical patterns evolve, traders are advised to monitor volume spikes and price reactions near resistance levels to gauge the sustainability of the current rebound.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.