BTC and ETH show weakness near critical support zones amid declining ETF inflows

Bitcoin (BTC) and Ethereum (ETH) both extended their weekly declines, dropping to $107,000 and $3,700 respectively, as traders reacted to weakening on-chain momentum and fading ETF inflows. Analysts say the move signals a short-term cooling phase after months of sustained gains.

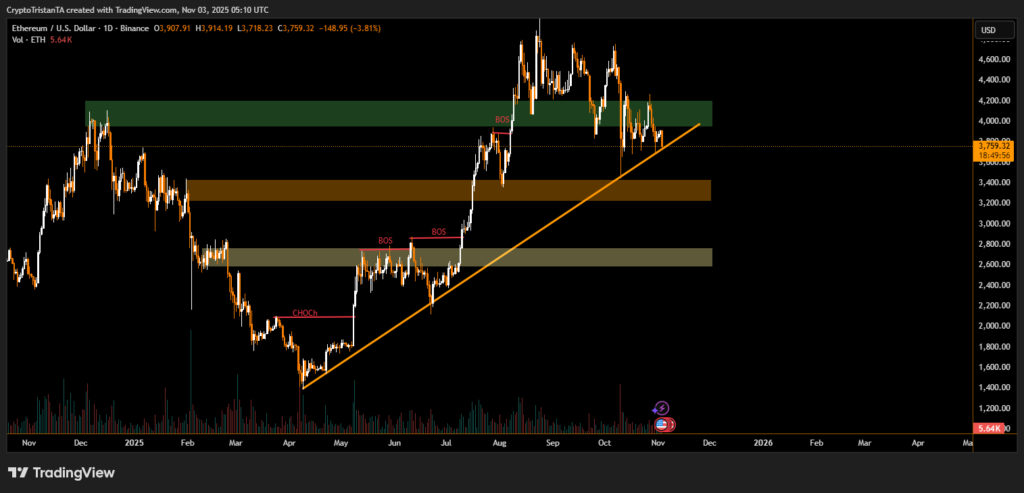

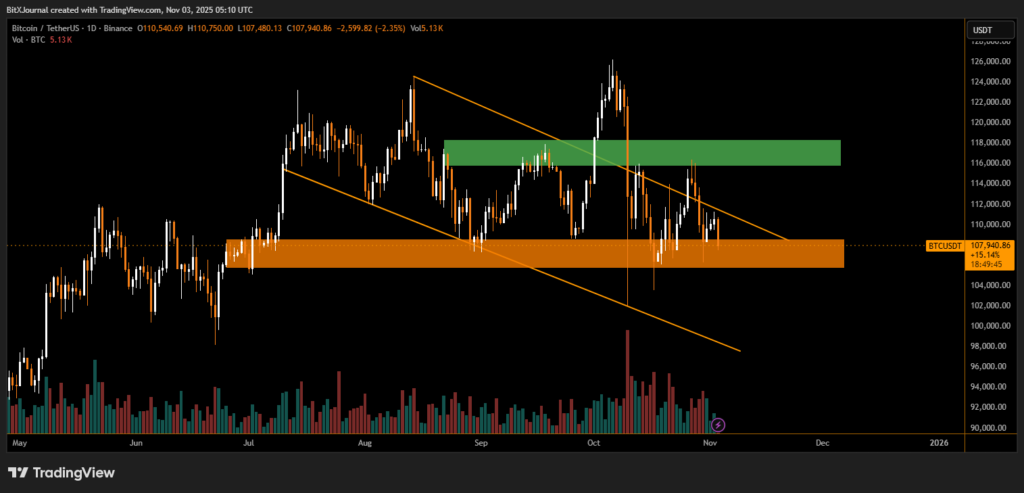

According to market data, Bitcoin’s price slipped over 2% in the past 24 hours, revisiting the orange support zone between $105K and $108K, a level that has historically acted as a demand region for large buyers. Meanwhile, Ethereum’s retracement to $3,700 brought it directly into contact with a long-term ascending trendline, visible since the April 2025 recovery.

“The market is showing exhaustion after a parabolic run. ETF inflows have slowed, and traders are rotating capital toward mid-cap assets,” said senior BitXJournal crypto analyst at MarketView Research.

Technical breakdown points to consolidation phase

On the daily chart, BTC remains in a descending channel, suggesting a possible retest of $105,000 if the orange support fails to hold. The upper resistance near $115,000–$118,000 remains the key breakout zone for any renewed bullish momentum.

For Ethereum, price action indicates a series of break-of-structure (BOS) points that now act as local resistances. The $3,400–$3,600 zone is seen as the next critical demand area should selling pressure continue.

“Ethereum’s ascending support line has held for months, but traders should watch for a daily close below $3,700,” noted Arjun Patel, head of digital assets at QuantumTrade Analytics. “That would signal potential weakness toward $3,400.”

Investor sentiment remains cautious

Despite the dip, on-chain data shows exchange inflows remain moderate, suggesting that long-term holders are not exiting positions aggressively. However, sentiment indicators continue to hover in the “neutral-to-fear” range.

“Both BTC and ETH are testing crucial levels — what happens next week could define the November trend,” said BitXJournal .

In summary, while Bitcoin’s $107K and Ethereum’s $3,700 levels are attracting technical interest, sustained upside will depend on ETF inflows, macro signals, and volume confirmation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.