Descending Triangle Tightens; Traders Monitor Key Support for Continuation Signal

XRP slid roughly 7% in the latest session, continuing a controlled retreat as price action compressed inside a tightening technical formation. The token moved toward a critical support band near the mid-$2.20s, where buyers have historically stepped in, yet the tone of trading signaled caution rather than aggressive accumulation.

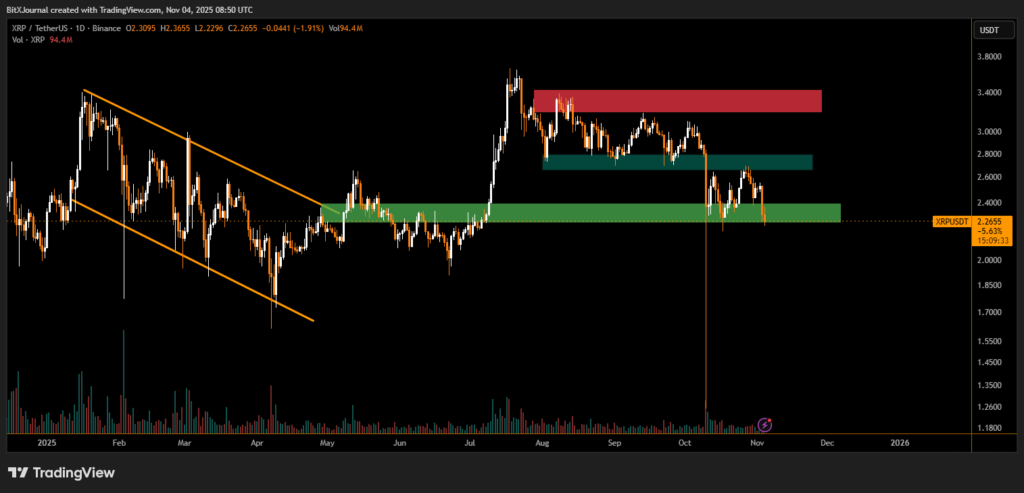

This decline follows repeated attempts to reclaim overhead supply zones, with each rally stalling beneath prior distribution levels. The chart now reflects a descending triangle structure, marked by lower highs converging on a flat support base—typically a bearish continuation signal if breakdown confirms.

Despite brief intraday volatility spikes, trading volumes stayed below trend, reinforcing the view that current flows represent selective dip-buying and defensive positioning, not broad conviction. That dynamic mirrors what technicians observe across several large-cap altcoins: liquidity is present, but participation remains reactive, not proactive.

“The market isn’t capitulating, but it’s not bidding aggressively either,” said a BitXJournal digital-asset market strategist. “When price compresses like this with declining volume, it often precedes a decisive move. The burden is on bulls to defend the floor.”

XRP previously broke out of a major descending channel mid-year, generating momentum that carried the token into multi-month highs. Since then, heavy supply in the $3.00–$3.40 region halted upside, prompting consolidation. The latest pullback has brought the token back to the upper edge of a summer accumulation zone.

A clean break below the $2.25–$2.30 support window would signal structural weakness, potentially opening a move toward deeper liquidity pockets. Conversely, a daily close back above $2.60 could reset bullish prospects and invalidate the near-term bearish pattern.

“This is less about sentiment and more about structure,” noted BitXJournal analyst. “Until XRP reclaims mid-range levels with volume expansion, rallies will struggle to gain traction.”

For now, traders are watching whether the support band serves as a base or becomes a breakdown trigger. With volatility compressing and momentum softening, the next directional move may come swiftly once liquidity tips. In the meantime, disciplined positioning remains the dominant theme as the market waits for confirmation rather than speculation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.