Despite positive institutional headlines, LINK’s price action turns bearish with eyes on $14 support zone

Chainlink’s native token LINK faced renewed selling pressure on Tuesday, dropping nearly 6% to $14.89, as a technical breakdown overshadowed recent bullish sentiment from new institutional collaborations.

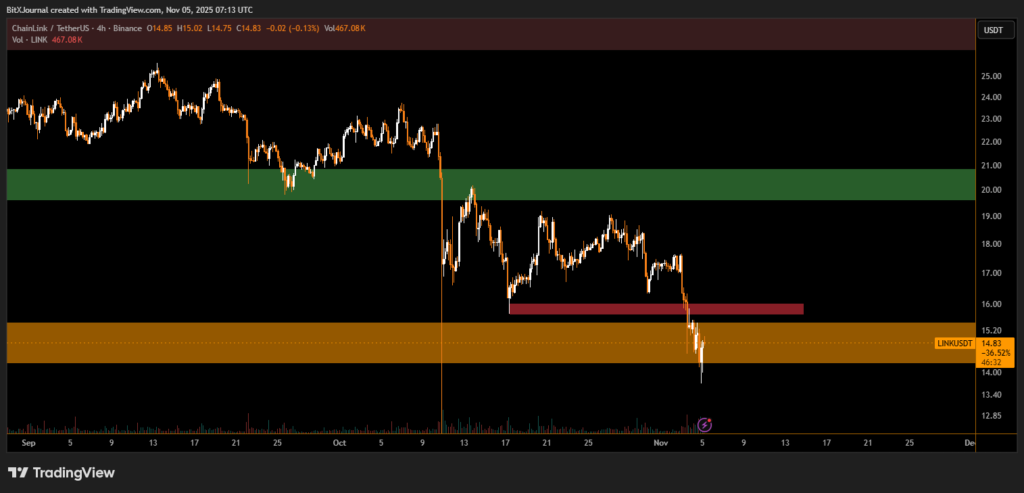

The decline came even after Chainlink’s integration news with UBS and FTSE-linked initiatives briefly lifted market optimism earlier in the week. However, traders quickly shifted focus back to charts, where LINK’s price broke decisively below the $15.50–$16.00 support zone, confirming what analysts described as a “broader structural weakness” in the current market setup.

“The $15 area was the last near-term defense. Losing that level puts the $14 zone in play — a key demand region that previously triggered rebounds in August,” said one BitXJournal technical strategist.

On the 4-hour chart, LINK is trading below all major moving averages, with volume spikes accompanying each sell-off phase — a signal that institutional participants may be unwinding positions after failing to sustain momentum above $20 earlier in October. The next notable support lies between $13.80 and $14.20, highlighted by the orange zone on the chart.

Still, not all observers are pessimistic. Some market participants argue that the recent dip could be a “liquidity sweep” before accumulation resumes. “Chainlink’s long-term structure remains strong as long as the $14 base holds. The ecosystem fundamentals are improving, even if price action looks weak short term,” .

If LINK reclaims the $16 zone, it may trigger a short-covering rally toward $18; however, failure to defend $14 could open the path toward $12.80.

For now, the market appears focused on whether buyers can stabilize LINK near $14.50, with traders closely watching volume reactions in that region.

Chainlink’s price action suggests that technicals—not partnerships—are currently dictating sentiment, with the $14 level standing as the make-or-break point for bulls.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.